Home › Group › Legal › L80 Accounting › L81 Accounting Basic Info

L81 Accounting Basic Info

Page no: L82

| Step |

Title |

Usual way of doing |

Alternative ways |

Software aided

|

|

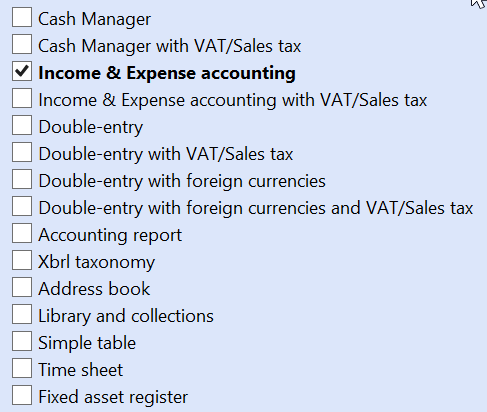

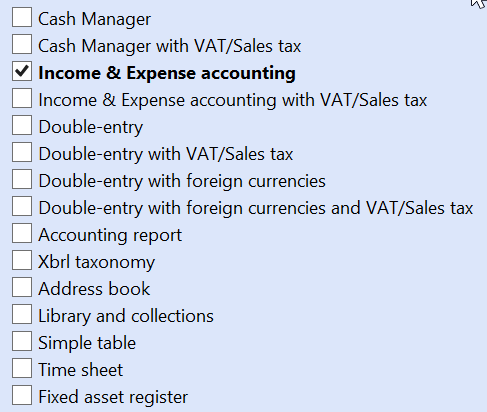

Account type

|

Typical Alternatives:

- Income/Expense accounting (with or without VAT)

- Double Entry (with or without VAT)

- Double Entry with foreign currencies (with or without VAT)

|

|

|

|

Company Name

|

|

|

Odoo |

|

Bank Accounts

|

- For each bank account create an accounting account

|

|

Odoo Best practices in Youtube

Link to Odoo

|

|

FX rates |

Double Entry with currencies

- Obtain Official FX rates from Swiss tax authorities

- Do FX Rates setup (e.g. in Banana)

- Choose base currency

- Must run an FX reconcilation process that calculates FX P/L.

|

- Maintain FX rates in an Excel

- Take FX rate from the day of booking

- Transactions converted into base currency in the Excel

- If payment date is different from the invoice date by some days, then use the rate.

- No FX Profit and Loss

|

Odoo |

|

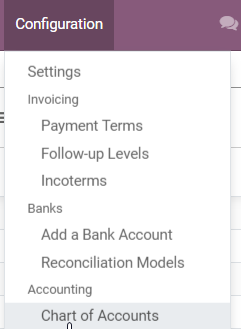

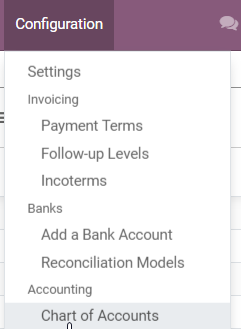

Chart of Accounts

|

- Choose an accounting schema (e.g. in Banana)

- or import the schema and add additional accounts

- or continue the balance sheet from the previous year.

|

Simplified accounting

|

Odoo Best practices in Youtube |

|

Opening Balances

|

Usually you keep the file/data from the previous year

and simply create a new year. |

Create a new account file:

In Banana one can copy it from the previous year, when creating a new file for the next year.

Verify the balances against the previous year, |

link to youtube

Journal for opening balances and post it |

|

Date Format |

Date Format:

- Prefer YYYY-MM-DD, like 2019-01-19

|

|

|

|

|

|

|

|

See more for L8x Accounting