Page no: R62

Tag Table1: Eurozone, Germany, France

with links to snbchf

(same names in same row: Unemployment Rate,Eurozone M3 Money Supply, Eurozone Ratail PMI, Germany Manufacturing PMI)

| Date in Month | Eurozone Tag with Link to our site behind …………………………………. |

Eurozone Tag Archive year/month | Bigger Holes |

Germany Tag with Link to our site behind

………………………………………………. |

Germany/ItalyTag Archive year/month | (tagDescription)…………………………………………………………………………………………………… |

|---|---|---|---|---|---|---|

| 01, 31

|

Eurozone Unemployment Rate | 2016/08 – 2020/ 04 | missing 2018/05- 2019/05 |

Germany Unemployment Rate | 2016/06- 2020/04 | Unemployment rate measures the percentage of the total work force that is unemployed and actively seeking employment during the reported month. |

| 17, 18, 30, 31 | Eurozone Consumer Price Index | 2016/02 – 2020/05 | Germany Consumer Price Index | 2016/06 – 2020/05 | The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation. | |

| 17, 18, 30, 31 | Eurozone Core CPI | 2016/08 – 2020/05 | The Core Consumer Price Index (CPI) measures the changes in the price of goods and services, excluding food and energy. The CPI measures price change from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation. | |||

| Eurozone Current Account | 2016/08 – 2020/05 | The Current Account index measures the difference in value between exported and imported goods, services and interest payments during the reported month. The goods portion is the same as the monthly Trade Balance figure. Because foreigners must buy the domestic currency to pay for the exports the data can have a sizable affect on the EUR. | ||||

| Eurozone Markit Composite PMI | 2016/06 – 2020/06 | Germany Composite PMI

STOPPED |

2016/10 – 2019/04 | The PMI monthly Composite Reports on Manufacturing and Services are based on surveys of over 300 business executives in private sector manufacturing companies and also 300 private sector services companies. Data is usually released on the third working day of each month. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Replies from larger companies have a greater impact on the final index numbers than those from small companies. Results are presented by question asked, showing the percentage of respondents reporting an improvement, deterioration or no change since the previous month. From these percentages, an index is derived: a level of 50.0 signals no change since the previous month, above 50.0 signals an increase (or improvement), below 50.0 a decrease. | ||

| Eurozone Gross Domestic Product QoQ | 2016/06 – 2020/05 | Germany Gross Domestic Product | 2016/08 – 2020/05 | Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health. A stronger than expected number should be taken as positive for the EUR and a lower than expected number as negative to the EUR. | ||

| Eurozone Industrial Production | 2016/06 – 2020/06 | Germany Industrial Production | 2016/06 – 2020/06 | Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities. | ||

| 01, 23 | Eurozone Manufacturing PMI | 2016/06 – 2020/06 | Germany Manufacturing PMI | 2016/08 – 2020/05 | The Manufacturing Purchasing Managers’ Index (PMI) measures the activity level of purchasing managers in the manufacturing sector. A reading above 50 indicates expansion in the sector; below 50 indicates contraction. Traders watch these surveys closely as purchasing managers usually have early access to data about their company’s performance, which can be a leading indicator of overall economic performance. | |

| Germany IFO Business Climate Index | 2016/06 – 2020/06 | The Germany Ifo Business Climate Index rates the current Germany business climate and measures expectations for the next six months. It is a composite index based on a survey of manufacturers, builders, wholesalers and retailers. The index is compiled by the Ifo Institute for Economic Research. | ||||

| Germany IFO Business Expectations | 2016/09 – 2020/06 | Germany Business Expectations rates the expectations of businesses in Germany for the following six months. It is is a sub-index of the Germany Ifo Business Climate Index. | ||||

| Eurozone Retail Sales | 2016/07 – 2020/05 | Germany Retail Sales

STOPPED |

2016/06 – 2019/07 | Retail sales are an aggregated measure of the sales of retail goods over a stated time period, typically based on a data sampling that is extrapolated to model an entire country. Measuring consumer demand for finished goods, retail sales help gauge the pulse of an economy and its projected path toward expansion or contraction. As a leading macroeconomic indicator, healthy retail sales figures typically elicit positive movements in equity markets. | ||

| Eurozone Services PMI | 2016/06 – 2020/06 | Germany Services PMI

STOPPED |

2016/10 – 2019/08 | The Service PMI release is published monthly by Markit Economics. The data are based on surveys of over 400 executives in private sector service companies. The surveys cover transport and communication, financial intermediaries, business and personal services, computing & IT, hotels and restaurants. | ||

| Eurozone Producer Price Index | 2016/07 – 2020/06 | Germany Producer Price Index

STOPPED |

2016/08 – 2019/08 | A Producer Price Index (PPI) is a price index that measures the average changes in prices received by domestic producers for their output. Its importance is being undermined by the steady decline in manufactured goods as a share of spending. | ||

| Eurozone Trade Balance | 2016/10 – 2020/05 | Germany Trade Balance

STOPPED |

2016/08 – 2019/06 | The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation’s exports and imports over a certain period. Sometimes a distinction is made between a balance of trade for goods versus one for services.

If a country exports a greater value than it imports, it is called a trade surplus, positive balance, or a “favourable balance”, and conversely, if a country imports a greater value than it exports, it is called a trade deficit, negative balance, “unfavorable balance”, or, informally, a “trade gap”. |

||

| Eurozone Consumer Confidence | 2016/10 – 2020/06 | Consumer Confidence measures the level of consumer confidence in economic activity. It is a leading indicator as it can predict consumer spending, which plays a major role in overall economic activity. The reading is compiled from a survey of about 2,300 consumers in the euro zone which asks respondents to evaluate future economic prospects. Higher readings point to higher consumer optimism. | ||||

| Eurozone ZEW Economic Sentiment | 2016/06 – 2020/05 | Germany ZEW Economic Sentiment

STOPPED |

2016/06 – 2018/07 | A monthly economic survey. The ZEW Economic Sentiment is an almalgamation of the sentiments of approximately 350 economists and analysts regarding the economic future of Germany for the next six months. The survey shows the balance between those analysts who are optimistic about Germany’s economic future and those who are not. |

Tag Table 2: United Kingdom, Italy, Spain

(same names in same row: Consumer Price Index)

| Day in Month | United Kingdom Tag with Link behind | Tag Archive year/month | Italy Tag with Link behind | Tag Archive year/month | Spain Tag with Link behind | Tag Archive year/month | Explanation ……………………………………………………………………………………………………………………………………… |

|---|---|---|---|---|---|---|---|

| U.K. Average Earnings | 2016/08 – 2027/07 |

STOPPEDall except 3 |

STOPPED all except 2

|

The Average Earnings Index measures change in the price businesses and the government pay for labor, including bonuses. The Average Earnings figure gives us a good indication of personal income growth during the given month. | |||

| U.K. Gross Domestic Product

KEEP |

2016/07 – 2020/06 | Italy Consumer Price Index

STOPPED |

2016/08 – 2018/05 | Spain Consumer Price Index

STOPPED |

2016/06 – 2018/05 | The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation. | |

| U.K. Gross Domestic Product

KEEP |

2016/07 – 2020/06 | Italy Gross Domestic Product

KEEP |

2016/08 – 2020/05 | Spain Gross Domestic Product

KEEP |

2017/01 – 2018/06 | Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health. A stronger than expected number should be taken as positive for the EUR and a lower than expected number as negative to the EUR. | |

| U.K. House Price Index | 2016/07 – 2019/09

not updated in investing |

The Office for National Statistics House Price Index measures the change in the selling price of homes. This data tends to have a relatively mild impact because there are several earlier indicators related to house prices. | |||||

| U.K. Manufacturing PMI

KEEP |

2016/07 – 2020/06 | Italy Manufacturing PMI

STOPPED |

2016/06 – 2018/04 | Spain Manufacturing PMI

STOPPED |

2016/11 – 2018/05 | The Manufacturing Purchasing Managers’ Index (PMI) measures the activity level of purchasing managers in the manufacturing sector. A reading above 50 indicates expansion in the sector; below 50 indicates contraction. Traders watch these surveys closely as purchasing managers usually have early access to data about their company’s performance, which can be a leading indicator of overall economic performance. | |

| U.K. Services PMI

KEEP |

2016/06 – 2020/06 | Italy Services PMI

STOPPED |

2016/08 – 2018/03 | Spain Services PMI

STOPPED |

2016/09 – 2018/03 | The Service PMI release is published monthly by Markit Economics. The data are based on surveys of over 400 executives in private sector service companies. The surveys cover transport and communication, financial intermediaries, business and personal services, computing & IT, hotels and restaurants. | |

| U.K. Trade Balance

KEEP |

2016/08 – 2020/05 | Spain Trade Balance

STOPPED |

2016/11 – 2018/02 | The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation’s exports and imports over a certain period. Sometimes a distinction is made between a balance of trade for goods versus one for services.

If a country exports a greater value than it imports, it is called a trade surplus, positive balance, or a “favourable balance”, and conversely, if a country imports a greater value than it exports, it is called a trade deficit, negative balance, “unfavorable balance”, or, informally, a “trade gap”. |

|||

| U.K. Unemployment Rate

KEEP |

2016/06 – 2020/05 | Spain Unemployment Rate

KEEP |

2016/07 – 2018/01 | The Unemployment Rate measures the percentage of the total work force that is unemployed and actively seeking employment during the previous month. |

Tag Table3: United States, China, Japan

(same names in same row: Consumer Price Index)

| Day in Month | United States Tag with Link behind | Tag Archive year/month | China Tag with Link behind | Tag Archive year/month | Japan Tag with Link behind | Tag Archive year/month | Explanation, …………………………………………………………………………………………………………………………………………………………………………. |

|---|---|---|---|---|---|---|---|

| U.S. ADP Еmployment Change | 2016/06 – 2017/01 | ||||||

| China Caixin Manufacturing PMI

KEEP |

2016/09 – 2020/06 | The Chinese HSBC Manufacturing PMI is a composite indicator designed to provide an overall view of activity in the manufacturing sector and acts as an leading indicator for the whole economy. When the PMI is below 50.0 this indicates that the manufacturing economy is declining and a value above 50.0 indicates an expansion of the manufacturing economy.

Flash figures are released approximately 6 business days prior to the end of the month. Final figures overwrite the flash figures upon release and are in turn overwritten as the next Flash is available. The Chinese HSBC Manufacturing PMI is concluded from a monthly survey of about 430 purchasing managers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories. A higher than expected reading should be taken as positive/bullish for the CNY , while a lower than expected reading should be taken as negative/bearish for the CNY. |

|||||

| U.S. ADP Nonfarm Employment Change | 2017/01 – 2020/06 | The ADP National Employment Report is a measure of the monthly change in non-farm, private employment, based on the payroll data of approximately 400,000 U.S. business clients. The release, two days ahead of government data, is a good predictor of the government’s non-farm payroll report. The change in this indicator can be very volatile. | |||||

| China Caixin Services PMI | 2016/06 – 2020/06 | The Chinese HSBC Services PMI is compiled by questionnaires sent to purchasing executives in over 400 private service sector companies. The panel has been carefully selected to accurately replicate the true structure of the services economy. The HSBC Services PMI Index is developed for providing the most up-to-date possible indication of what is really happening in the private sector economy by tracking variables such as sales, employment, inventories and prices. A higher than expected reading should be taken as positive/bullish for the CNY , while a lower than expected reading should be taken as negative/bearish for the CNY. |

|||||

| Japan Current Account n.s.a. | 2016/10 – 2020/05 | The Current Account index measures the difference in value between exported and imported goods, services and interest payments during the reported month. The goods portion is the same as the monthly Trade Balance figure A higher than expected reading should be taken as positive/bullish for the JPY , while a lower than expected reading should be taken as negative/bearish for the JPY |

|||||

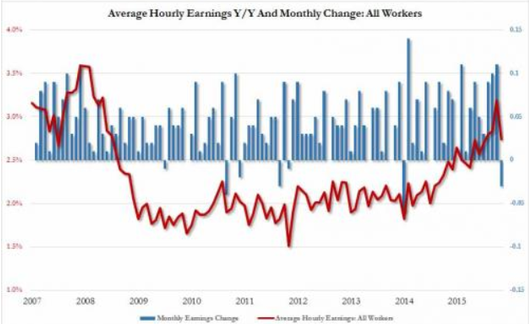

| U.S. Average Earnings | 2016/04 – 2017/11 | The Average Earnings Index measures change in the price businesses and the government pay for labor, including bonuses. The Average Earnings figure gives us a good indication of personal income growth during the given month. | |||||

| U.S. Average Hourly Earning | 2017/01 – 2017/11 | Average Hourly Earnings measures the change in the price businesses pay for labor, not including the agricultural sector. | |||||

| U.S. Capacity Utilization

KEEP |

2016/10 – 2017/10 | The Capacity Utilization Rate is the percentage of production capacity being utilized in the U.S.(available resources includes factories, mines and utilities). Capacity Utilization reflects overall growth and demand in the economy. It can also act as a leading indicator of consumer price inflation. | |||||

| China Fixed Asset Investment | 2016/08 – 2020/05 | Chinese Fixed Asset Investment measures the change in the total spending on non-rural capital investments such as factories, roads, power grids, and property. | |||||

| U.S. Car Sales | 2016/10 – 2019/10 | All Car Sales is a report by the Bureau of Economic Analysis on the sales of all passenger cars, including station wagons, A strong number will indicate a strong economy. A higher than expected number should be taken as positive to the USD, while a lower than expected number as negative | |||||

| China Money Supply M1 | 2016/10 | Money supply is the entire stock of currency and other liquid instruments circulating in a country’s economy as of a particular time. Also referred to as money stock, money supply includes safe assets, such as cash, coins, and balances held in checking and savings accounts that businesses and individuals can use to make payments or hold as short-term investments. | |||||

| U.S. Case Shiller Home Price Index

KEEP |

2016/06 | The S&P/Case-Shiller House Price Index measures the change in the selling price of single-family homes in 20 metropolitan areas. | |||||

| China New Loans | 2016/08 – 2020/05 | This release measures the change in the total value of outstanding bank loans issued to consumers and businesses. Borrowing and spending are closely correlated with consumer confidence. A higher than expected reading should be taken as positive/bullish for the CNY , while a lower than expected reading should be taken as negative/bearish for the CNY. |

|||||

| U.S. Chicago PMI

KEEP |

2016/02 – 2018/03 | The Chicago Purchasing Managers’ Index (PMI) determines the economic health of the manufacturing sector in Chicago region. A reading above 50 indicates expansion of the manufacturing sector; a reading below indicates contraction. The Chicago PMI can be of some help in forecasting the ISM manufacturing PMI. | |||||

| U.S. Consumer Price Index

KEEP |

2016/04 – 2020/05 | China Consumer Price Index | 2016/10 – 2020/05 | Japan National Consumer Price Index | 2016/08 – 2019/10 | The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation. | |

| U.S. Core Consumer Price Index

KEEP |

2016/10 – 2020/03 | Japan National Core Consumer Price Index | 2016/12 – 2019/10 | The Core Consumer Price Index (CPI) measures the changes in the price of goods and services, excluding food and energy. The CPI measures price change from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation. | |||

| U.S. Core PCE Price Index

KEEP |

2016/06 – 2020/06 | The Core PCE price Index is the less volatile measure of the PCE price index which excludes the more volatile and seasonal food and energy prices. The impact on the currency may go both ways, a rise in inflation may lead to a rise in interest rates and a rise in local currency, on the other hand, during recession, a rise in inflation may lead to a deepened recession and therefore a fall in local currency. | |||||

| U.S. Crude Oil Inventories

KEEP |

2016/06 – 2020/05 | The Energy Information Administration’s (EIA) Crude Oil Inventories measures the weekly change in the number of barrels of commercial crude oil held by US firms. The level of inventories influences the price of petroleum products, which can have an impact on inflation.

If the increase in crude inventories is more than expected, it implies weaker demand and is bearish for crude prices. The same can be said if a decline in inventories is less than expected. |

|||||

| U.S. Current Account

KEEP |

2016/09- 2017/12 | Japan Current Account

KEEP |

2016/08 – 2019/11 | The Current Account index measures the difference in value between exported and imported goods, services and interest payments during the reported month. The goods portion is the same as the monthly Trade Balance figure. Because foreigners must buy the domestic currency to pay for the exports the data can have a sizable affect on the EUR. | |||

| U.S. Employment Change

KEEP |

2017/01- 2017/09 | Employment Change measures the change in the number of people employed. Job creation is an important indicator of consumer spending. | |||||

| U.S. Gross Domestic Product

KEEP |

2016/06 – 2020/05 | China Gross Domestic Product

KEEP |

2016/07 – 2020/01 | Japan Gross Domestic Product

KEEP |

2016/06 – 2020/05 | Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health. | |

| U.S. Housing Starts | 2016/04 – 2020/05 | Housing starts measures the change in the annualized number of new residential buildings that began construction during the reported month. It is a leading indicator of strength in the housing sector. | |||||

| Japan, Household Spending | 2017/01 – 2020/05 | Household Spending measures the change in the inflation-adjusted value of all expenditures by consumers. | |||||

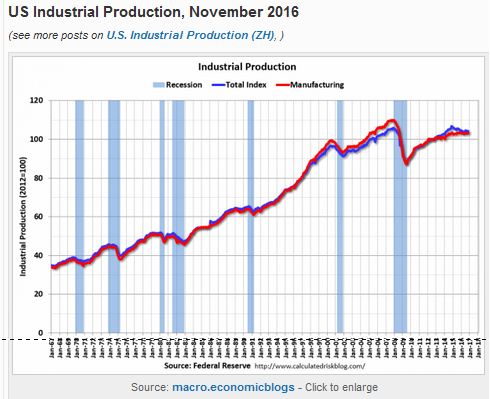

| U.S. Industrial Production

KEEP |

2017/01 – 2020/05 | China Industrial Production | 2016/07 – 2020/05 | Japan Industrial Production | 2016/06 – 2020/05 | Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities. | |

| U.S. Initial Jobless Claims

KEEP |

2016/04 – 2020/05 | Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week. | |||||

| U.S. ISM Manufacturing Employment

KEEP |

2016/12 – 2020/06 | The Institute of Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) Report on Business is based on data compiled from monthly replies to questions asked of purchasing and supply executives in over 400 industrial companies. For each of the indicators measured (New Orders, Backlog of Orders, New Export Orders, Imports, Production, Supplier Deliveries, Inventories, Customers Inventories, Employment, and Prices), this report shows the percentage reporting each response, the net difference between the number of responses in the positive economic direction and the negative economic direction and the diffusion index. Responses are raw data and are never changed.

The diffusion index includes the percent of positive responses plus one-half of those responding the same (considered positive). The resulting single index number is then seasonally adjusted to allow for the effects of repetitive intra-year variations resulting primarily from normal differences in weather conditions, various institutional arrangements, and differences attributable to non-moveable holidays. All seasonal adjustment factors are supplied by the U.S. Department of Commerce and are subject annually to relatively minor changes when conditions warrant them. The PMI is a composite index based on the seasonally adjusted diffusion indices for five of the indicators with varying weights: New Orders –30% Production –25% Employment –20% Supplier Deliveries –15% and Inventories — 10%. A higher than expected reading should be taken as positive/bullish for the USD, while a lower than expected reading should be taken as negative/bearish for the USD. |

|||||

| U.S. ISM Non-Manufacturing PMI

KEEP |

2016/07 -2020/01 | The Institute of Supply Management (ISM) Non-Manufacturing Purchasing Managers’ Index (PMI) (also known as the ISM Services PMI) report on Business, a composite index is calculated as an indicator of the overall economic condition for the non-manufacturing sector. The NMI is a composite index based on the diffusion indexes for four of the indicators with equal weights: Business Activity (seasonally adjusted), New Orders (seasonally adjusted), Employment (seasonally adjusted) and Supplier Deliveries.

A reading above 50 percent indicates the non-manufacturing sector economy is generally expanding; below 50 percent indicates the non-manufacturing sector is generally contracting. The Non-Manufacturing ISM Report on Business is based on data compiled from monthly replies to questions asked of more than 370 purchasing and supply executives in over 62 different industries representing nine divisions from the Standard Industrial Classification (SIC) categories. Membership of the Business Survey Committee is diversified by SIC category and is based on each industry contribution to Gross Domestic Product (GDP). A higher than expected reading should be taken as positive/bullish for the USD, while a lower than expected reading should be taken as negative/bearish for the USD. |

|||||

| China Non-Manufacturing PMI

KEEP |

2016/09 – 2020/04 |

China Non-Manufacturing Purchasing Managers Index (PMI) provides an early indication each month of economic activities in the Chinese Non-manufacturing sector.It is compiled by China Federation of Logistics & Purchasing (CFLP) and China Logistics Information Centre (CLIC), based on data collected by the National Bureau of Statistics (NBS).Li & Fung Research Centre is responsible for drafting and disseminating the English PMI report. Every month questionnaires are sent to over 700 Non-manufacturing enterprises all over China. The data presented here is compiled from the enterprises responses about their purchasing activities and supply situations. The PMI should be compared to other economic data sources when used in decision-making. A higher than expected reading should be taken as positive/bullish for the CNY , while a lower than expected reading should be taken as negative/bearish for the CNY.

|

|||||

| U.S. Manufacturing PMI

KEEP |

2017/02 – 2020/06 | China Manufacturing PMI

KEEP |

2016/07 – 2020/01 | Japan Manufacturing PMI | 2016/07 – 2020/06 | The Manufacturing Purchasing Managers’ Index (PMI) measures the activity level of purchasing managers in the manufacturing sector. A reading above 50 indicates expansion in the sector; below 50 indicates contraction. Traders watch these surveys closely as purchasing managers usually have early access to data about their company’s performance, which can be a leading indicator of overall economic performance. | |

| U.S. Michigan Consumer Sentiment

KEEP |

2016/12 – 2019/10 | The University of Michigan Consumer Sentiment Index rates the relative level of current and future economic conditions. There are two versions of this data released two weeks apart, preliminary and revised. The preliminary data tends to have a greater impact. The reading is compiled from a survey of around 500 consumers. | |||||

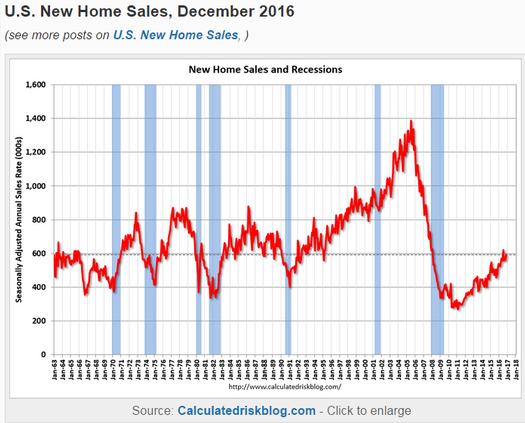

| U.S. New Home Sales | 2016/09 – 2020/05 | New Home Sales measures the annualized number of new single-family homes that were sold during the previous month. This report tends to have more impact when it’s released ahead of Existing Home Sales because the reports are tightly correlated. | |||||

| U.S. Nonfarm Payrolls

KEEP |

2016/04 – 2020/05 | Nonfarm Payrolls measures the change in the number of people employed during the previous month, excluding the farming industry. Job creation is the foremost indicator of consumer spending, which accounts for the majority of economic activity. | |||||

| U.S. Participation Rate

KEEP |

2016/05 – 2020/06 | The participation rate is an important indicator of the supply of labor. It measures the share of the working-age population either working or looking for work. The number of people who are no longer actively searching for work would not be included in the participation rate. A reading that is stronger than forecast is generally supportive (bullish) for the USD, while a weaker than forecast reading is generally negative (bearish) for the USD. |

|||||

| U.S. Personal Income

Decide |

2017/01 – 2020/06 |

Personal Income measures the change in the total value of income received from all sources by consumers. Income is closely correlated with consumer spending, which accounts for a majority of overall economic activity. | |||||

| U.S. Personal Spending

Decide |

2017/01 –

2020/04 |

Personal Spending measures the change in the inflation-adjusted value of all spending by consumers. Consumer spending accounts for a majority of overall economic activity. However, this report tends to have a mild impact, as government data on retail sales is released about two weeks earlier. | |||||

| U.S. Philadelphia Fed Manufacturing Index

KEEP |

2016/11 – 2018/02 | The Philadelphia Federal Reserve Manufacturing Index rates the relative level of general business conditions in Philadelphia. A level above zero on the index indicates improving conditions; below indicates worsening conditions. The data is compiled from a survey of about 250 manufacturers in the Philadelphia Federal Reserve district. | |||||

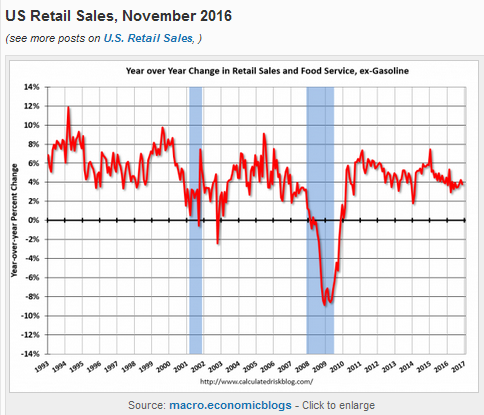

| U.S. Retail Sales

KEEP |

2016/05 – 2020/05 | China Retail Sales

KEEP |

2016/07 – 2020/05 | Japan Retail Sales | 2016/06 – 2020/05 | Retail sales are an aggregated measure of the sales of retail goods over a stated time period, typically based on a data sampling that is extrapolated to model an entire country. Measuring consumer demand for finished goods, retail sales help gauge the pulse of an economy and its projected path toward expansion or contraction. As a leading macroeconomic indicator, healthy retail sales figures typically elicit positive movements in equity markets. | |

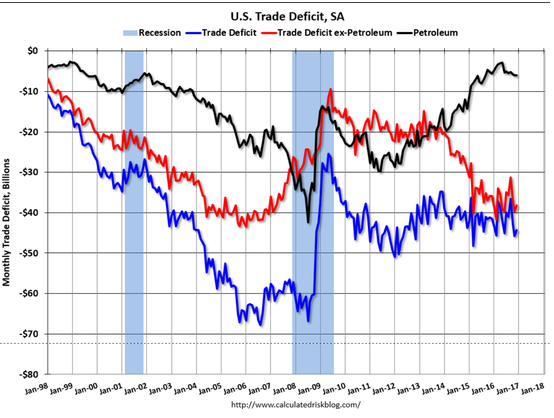

| U.S. Trade Balance

KEEP |

2016/07 – 2020/02 | China Trade Balance | 2016/06 – 2020/05 | Japan Trade Balance | 2016/06 – 2020/05 | The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation’s exports and imports over a certain period. Sometimes a distinction is made between a balance of trade for goods versus one for services.

If a country exports a greater value than it imports, it is called a trade surplus, positive balance, or a “favourable balance”, and conversely, if a country imports a greater value than it exports, it is called a trade deficit, negative balance, “unfavorable balance”, or, informally, a “trade gap”. |

|

| U.S. Unemployment Rate

KEEP |

2016/06 – 2020/05 | Japan Unemployment Rate | 2016/09 – 2020/04 | The Unemployment Rate measures the percentage of the total work force that is unemployed and actively seeking employment during the previous month. |

Australia

- Australia Consumer Price Index,

- Australia Participation Rate,

- Australia Retail Sales,

- Australia Unemployment Rate,

STOPPED

Tags for Daily FX from Zerohedge:

Tags from other sites than Investing.com

| Tag and link to archive | Macro Ecoblogs with Example Link |

Put the Example Graph | Explanation

(maybe Bulgarian) |

|---|---|---|---|

| United States Average Earnings | Zerohedge Feed from Macro |

||

| U.S. Consumer spending

together with U.S. Personal Income |

Zerohedge feed from Macro |

Example on snbchf |

|

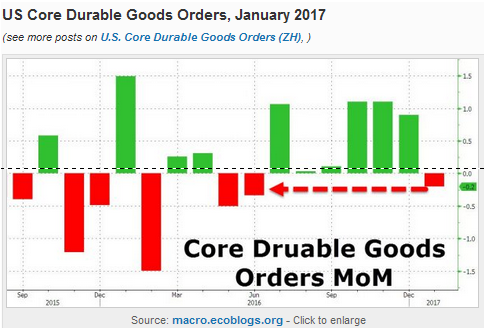

| U.S. Core Durable Goods Orders | Zerohedge feed from Macro |

||

| U.S. Industrial Production | Zerohedge feed from Macro |

||

| U.S. New Home Sales | Calculated Risk Feed from Macro |

||

| U.S. Retail Sales | Calculated Risk Feed fro Macro Economic Blogs. |

||

| U.S. Trade Balance | Calculated Risk Feed

from Macro |

See more for