Page no: SM49

This glossary aims to unify a list of glossaries. These are:

- TIM glossary and definitions inside the TIM

- Other documents in Real Time Settlements (RTS, formerly GSI)

- terms of the Business Capabilities Model (BCM)

- Financial channel terminology, in particular Swift

- General Operations and Banking terms

- Market Practices in APAC

- The Swiss SBIP, in particular the SLW Glossary. SLW is the SBIP system for securities settlement.

- The Global Payment Platform (GPP) that is currently only used in Switzerland.

(by Georg Morgen, January – April 2016)

The focus is on RTS.

References

- TIM 2.1 20140923.doc

- OPS TIM, Books & Records November 2015, KGOR, Andre Äppli

- The Credit Suisse business component model (BCM)

- SLW Glossary as outcome of the Cognizant description of SLW

- GPP documentation

Defintions without general value but specific for GDP and SLW are indicated in red colour. They are not relevant (yet) for RTS.

Glossary terms

Account Servicer |

||

(Swift) is the place where street-side accounts are contracted. An account servicer is typically a custodian bank, in our view our agent bank. The account owner of the account are typically financial institutions.

Account Transfer

a transfer of a position from one account to another

This can happen for a client-side account or a street-Side account.

| (SLW) Transfer of position from one account to another at same custodian. Scenarios of account transfer may typically arise in context of re-alignment requirements, e.g., moving positions between segregated and omnibus accounts as a result of a settlement instruction (or otherwise) |

Actual Booking

The actual booking happens when a settlement obligation has been settled, ie. when its instruction or advice has been fully matched.

(RTS) In the lifecycle of a settlement obligation, the actual booking happens when the SO is in status “settled”.

Actual Booking Model

In an actual booking model, transactions are only booked when the both the client-side transaction and the street-side implications are settled.

| (RTS) after manual setup in the settlement obligation generator, a Standard Settlement Instruction (SSI) can be reloaded in the Settlement Engine. Once to a fulfillment for the settlement obligation is received, then the expected booking is deciduous. Now the actual booking represents the reality which conforms with the one of the external world. In case of shapings, the FF link to shapes, not the original SO. The booking systems will therefore need to perform some logic to trace back to the settlement obligation. source TIM Books and Records |

| (SLW) When the booking in the client depot is effected after completion of securities settlement in the streetside. |

Advice (or Processing Advice)

is an detailed information flow from agent banks (account servicer) to the owners or assigned agents for street-side accounts about the ongoing processing of settlement.

For us as account owners, an advice contains

- detailed information is how our street-side accounts are moved

- and/or a status intimation.

An advice typically follows an earlier instruction that specified which street-side accounts were to be used.

The typical SWIFT messages for advices are

MT548: Processing Advice (in SLW mostly called “status intimation”)

MT900: Confirmation of Debit

MT910: Confirmation of Credit

Advices or (in RTS also) “notifications” initiated by a central counterparty do not need an earlier instruction.

See also –> unadvised

Agent Bank (or Agent)

(Synonym in SWIFT: account servicer, in SLW: custodian)

An agent bank is the financial institution where one or more of our street-side accounts are contracted and booked. Typically an agent bank does settlement and corporate actions in foreign markets for us.

An agent bank may be also our representative on some exchanges.

The wording “our custodian” is used as synonym for “our agent bank”.

See also –> Custodian Bank

Asset Class

Typical asset classes on the securities side are equities, bonds and funds and – on the payments side, a cashflow/cash.

(SLW) SLW has specific treatment per asset class only at detailed level, like specific attributes. The differences in major flows are triggered by the input system to SLW.

Asset Servicing

are the business capabilities related to corporate actions and transfers.

see BCM 7.5 Asset Servicing

Assigned Business Partner

| (SLW) An assigned business partner has its own relationship(account) with the CSD but uses another local custodian to facilitate settlement. In processing transactions for ABP, CS acts as an operator – as client has its own participant ID / accounts at the CSD. |

Back-Office

As opposed to Front-Office, the back-office is the part of the bank that is not directly related to clients or proprietary trading.

Operations belongs to back-office. Finance is sometimes considered to be part of back-office, for others it is a third part of the bank, separated from both front- and back-office.

Major Swiss banks are considering to create its an independent services company for back-office, IT and potentially even finance functions.

Back Pack

(RTS) is a special attribute store in a settlement obligation message (SOM) for attributes that

- do not concern settlement

- must be transmitted via a SOM to feed downstream applications.

Example1: Attributes in the back pack would be finance attributes. However, front-sourcing foresees that those do not pass via shared settlement components, but are sourced from front to finance directly.

Example2 Client-side position management: Attributes like blockings could pass via shared settlement components to the Client-Side position management system.

Beleg

(SLW) is the print-out of a confirmation in paper or electronic form. The confirmation can refer to a transaction or a settlement transaction.

Blocked Account

(synonym frozen accounts)

contains positions on either client- or street-side that were filtered by measures like sanction screening or money laundering.

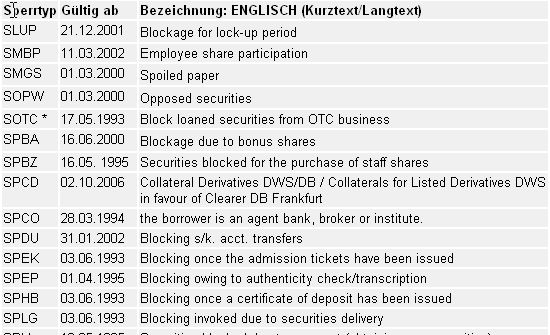

Blocking

(synonym reservation) is an operation on a position that makes it (temporarily) unavailable for trading. Blockings are created e.g. by securities lending, by the provision of collateral, or by corporate actions.

Examples from DBH:

Book

is a logical grouping of proprietary positions of the bank. Book is mostly used as a front-office term. Examples for the group is by trader, by financial asset type or by currency.

Hence the trader has his positions in “his book”. In finance, the term is often used as equivalent to a finance account.

Booking

is the process of updating account positions on client-side accounts, street-side accounts or finance accounts in the client-side position management, street-side position management and finance systems.

It is triggered by a booking request from the upstream systems.

As opposed to transactions and settlement obligations, bookings are single-sided, they concern only one account.

Booking is done for client-side positions , for street-side positions and in finance for the accounts in the sub-ledgers and the general ledger.

Booking causes movements on the accounts. It is triggered by a booking request.

RTS: In the Global Cash and Stock Record, booking is based on expected (expected view) and fulfilled settlement obligations (actual view).

SBIP/SLW: Booking for both Client-Side accounts and street-side accounts are done in the Swiss cash record XBS and the stock record DBS.

SLW triggers the creation of transactions in the order managers for street-side Accounts based on settlement transactions.

Booking Cycle

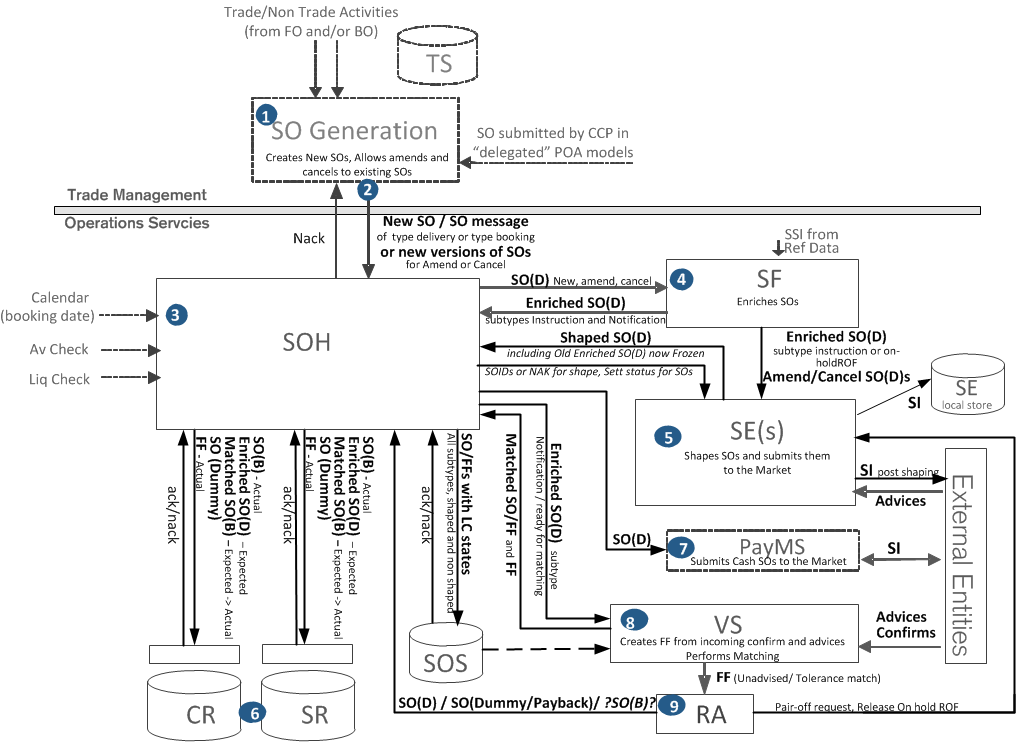

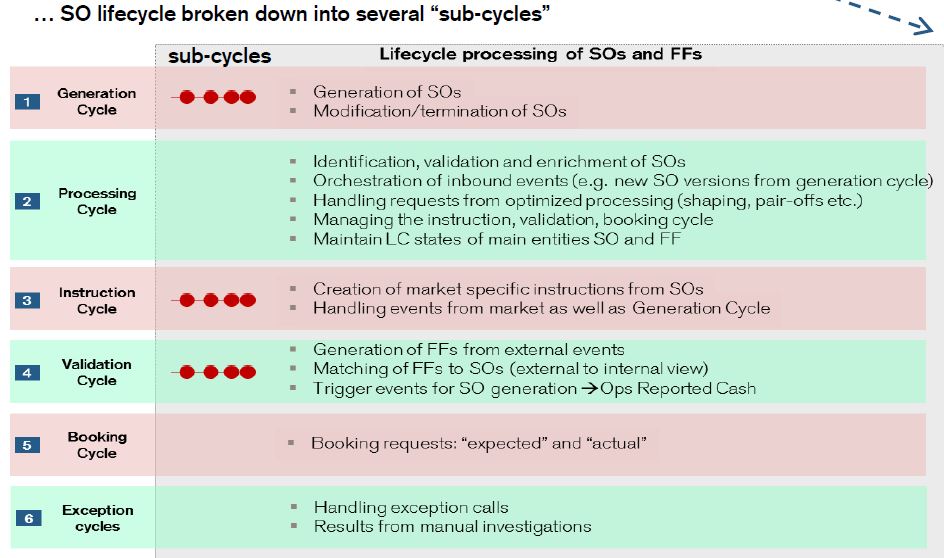

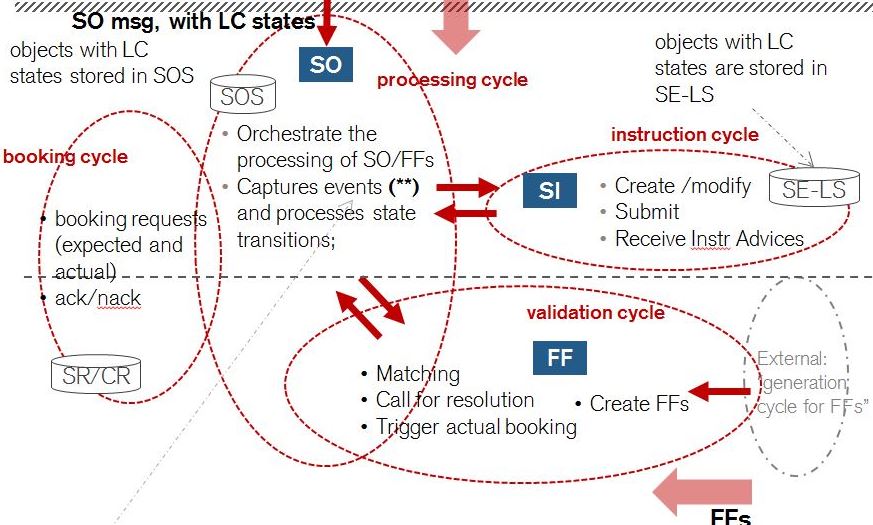

(RTS) In the booking cycle, two types of bookings are created.

When a (shaped) settlement obligation has arrived in status “Await Match”, then an expected booking entry is written in the Global Stock and Cash Record.

When the (shaped) settlement obligation has arrived in status settled, then the event “book” is started. It updates the expected booking entry with an “actual booking”.

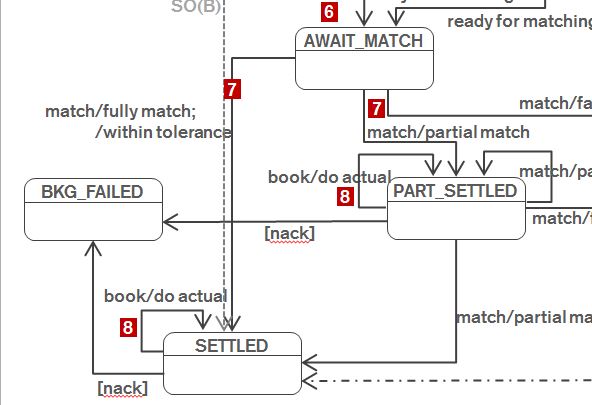

The following graph depicts the booking cycle.

Booking Details (German: Postenangaben)

| (SLW) The settlement transaction identifies actual securities booking to be applied to SBH, and the cash bookings (inc case SLW cash relevant). |

Booking Request

is a message of an upstream system (like WS-Infra or GPP or SOH) tso a client-side (like DBH) or street-side position management (like Global Cash and Stock Record) to do a booking with the data in the booking request.

Branch Code (German: Bankstelle)

The code of the branch, an office of the bank. A branch is a sub-unit of the business unit.

Broker

When an institution executes trade orders on behalf of a customer, then it is acting as a broker.

| (SLW) Facilitates execution of trade and undertakes primary intermediation role in securities market trading. For this reason, they have a primary role in the clearing & settlement processes |

Broker-Dealer

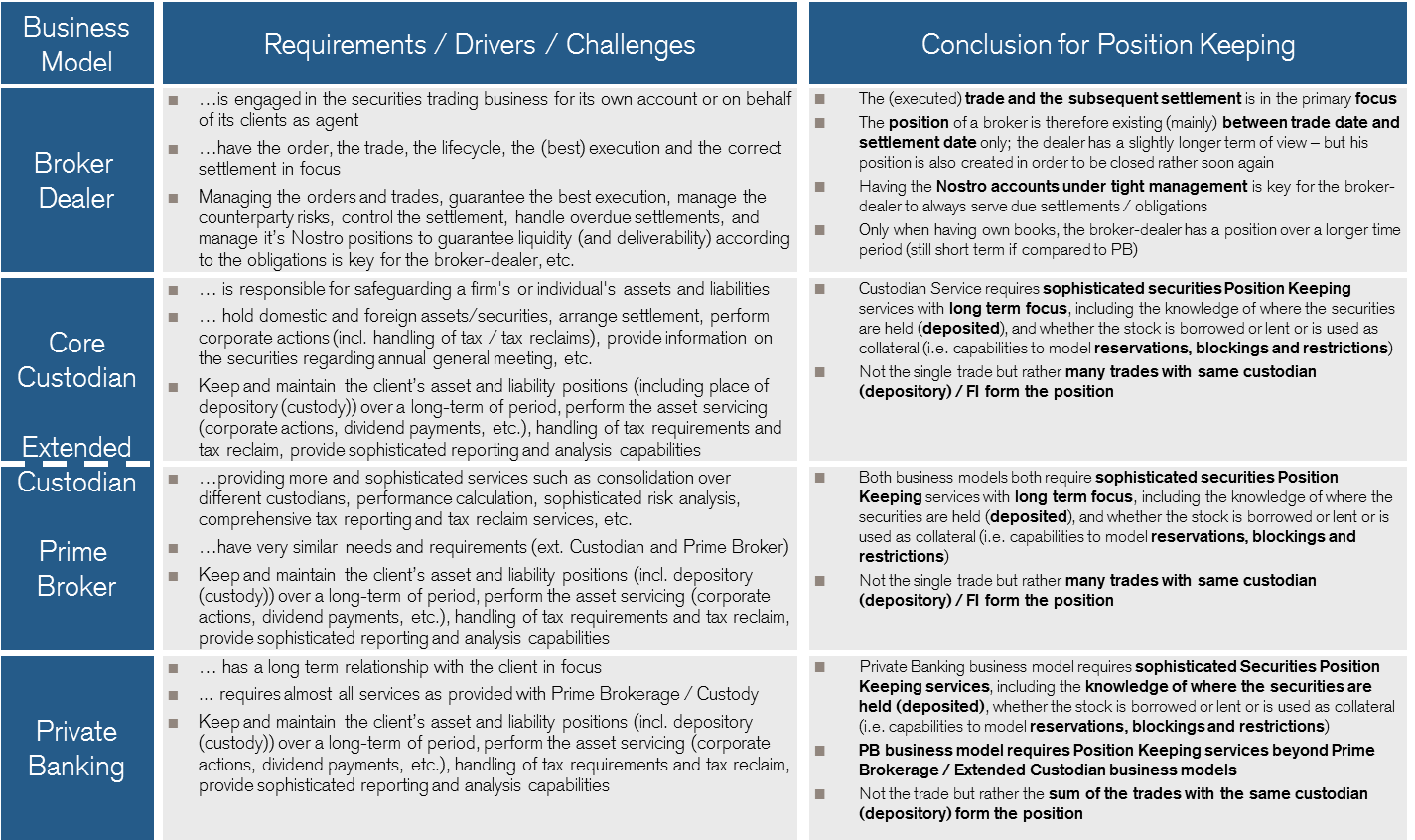

| (RTS) is a natural person, a company or other organization that engages in the business of trading securities for its own account or on behalf of its customers. Broker-dealers are at the heart of the securities and derivatives trading process. Although many broker-dealers are “independent” firms solely involved in broker-dealer services, many others are business units or subsidiaries of commercial banks, investment banks or investment companies source Books and Records TIM |

Broker-Dealer Model

The Broker-Dealer Model is a booking model used by many broker-dealers. Client-side positions, in particular the trading positions, are booked in the actual booking view, namely, when the street-side positions have been settled.

In short, booking happens after settlement. The opposite model is Contractual Booking

| (RTS) For brokers and dealers the (executed) trade and the subsequent settlement is in the primary focus

The position of a broker is therefore existing (mainly) between trade date and settlement date only; the dealer has a slightly longer term of view – but his position is also created in order to be closed rather soon again.

Having the Nostro accounts under tight management is key for the broker-dealer to always serve due settlements / obligations. Only when having own books, the broker-dealer has a position over a longer time period (still short term if compared to PB). source: Books and Records TIM |

Bulk Order

is the combination of multiple client orders into one order. Orders are bulked to reduce execution and settlement costs.

Bulk Settlement

is the settlement of multiple trades with one settlement obligation and/or one instruction. Bulk settlement only reduce settlement costs, but not execution costs.

see also –> shaping

Business Unit (BU)

| TIM: A Business Unit (BU) is a separate part of the bank, that is a specific business area (e.g. CS Private Banking Switzerland) within a legal entity or is itself a legal entity (LE, e.g. Neue Aargauer Bank, NAB ) |

Cancellation from Market

In the settlement area, a cancellation from market is a deletion of an instruction or an advice by a participant in our market network.

Cash Account

is an account for positions of type cash.

Cash and Liquidity Management

| BCM 7.6.1. The process to actively monitor and intervene in the settlement workflow (i.e. on street-side accounts) to ensure that it executes within the liquidity and inventory limits as set for the entity.

There are four outcomes of this process each of which leverages other BCM functions: |

(synonym: street-side Position Management)

Cash Booking

is the booking of positions in cash accounts. These accounts can be client-side accounts or street-side accounts or wash accounts.

In the SBIP, all three types of cash positions are booked into XBS.

Cashflow

Cashflows are the consequence of the executions of certain types of financial transactions. Some examples of these transactions are:

- Payments

- OTC contracts

- FX contracts

- The cash side for purchases of securities

- Corporate actions like interest payments or cash dividends.

Cash Feeder

The Cash Feeder is the system or part of a system that is responsible for cash flows.

GPP Client Side has cash feeder functionalities. A Cash Feeder is the system that sends cashflows to back-office and finance.

Cash Leg

(RTS) One of several legs of a settlement obligation. The cash leg is a store of cash-related attributes

see more under leg.

Cash Record

TIM: This is the posting engine for single customer accounts, internal accounts and Nostro accounts.

see also –> Global Stock and Cash Record

CCM (Continuous Cash Management)

is a Credit Suisse project that aims to improve intra-day liquidity on street-side accounts.

see –> Cash and Liquidity Management

Central counterparty (CCP)

is the central market maker at for certain exchanges.

| TIM: The CCP is an entity that interposes itself between counterparties to contracts traded in one or more financial markets, becoming the buyer to every seller and the seller to every buyer. Exchanges and clearing houses have a CCP. |

The typical market practice is the following flow:

- At the exchange, street-side orders are matched and the trades are recorded with the underlying counterparty.

- The underlying counterparty is replaced by the CCP, the trade is novated.

- Thanks to its PoA, the CCP initiates the settlement with an instruction, it creates a so-called “locked-in trade“.

- The trade is typically settled at a CSD.

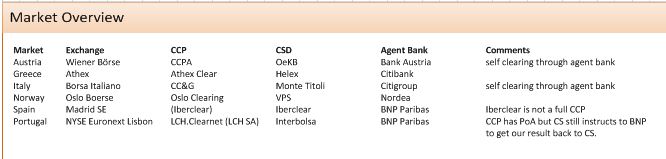

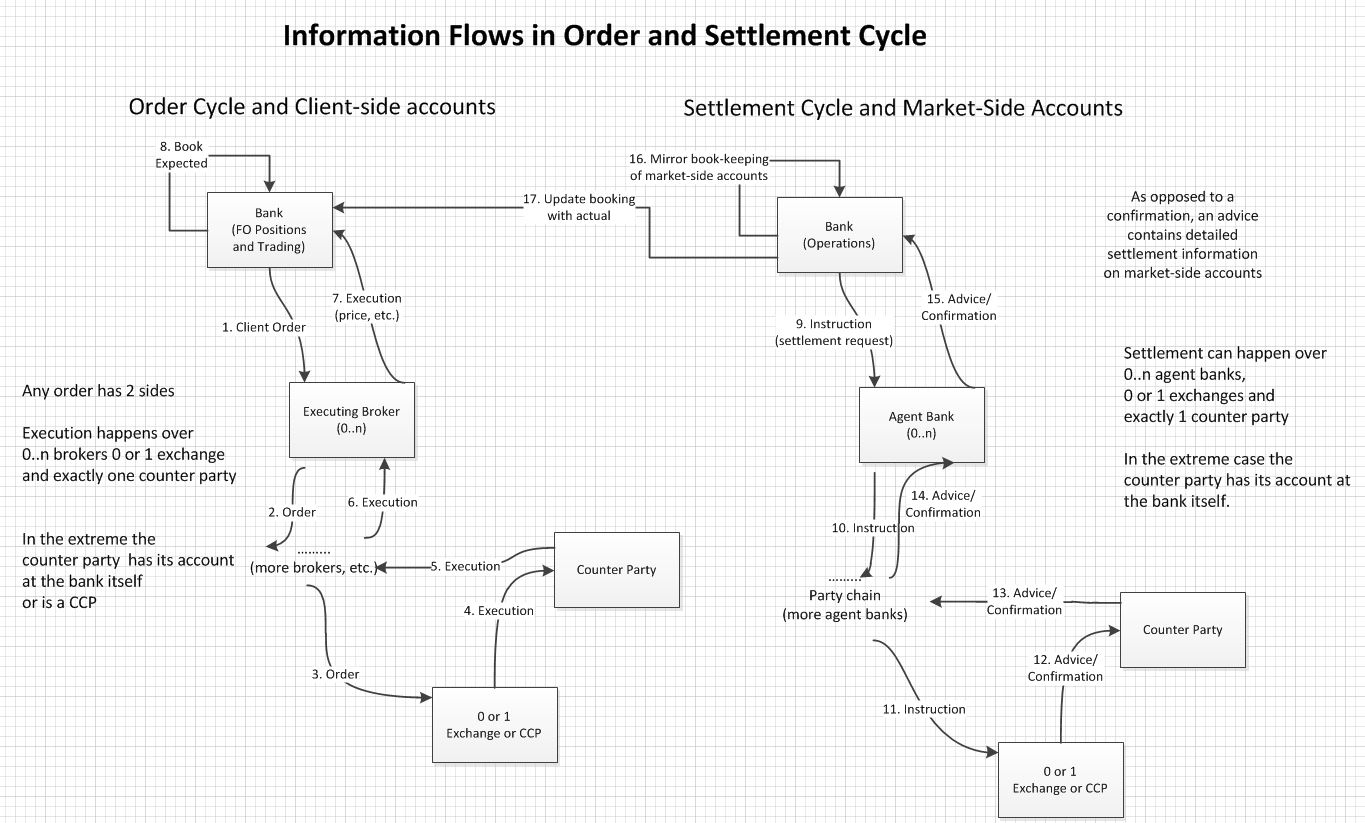

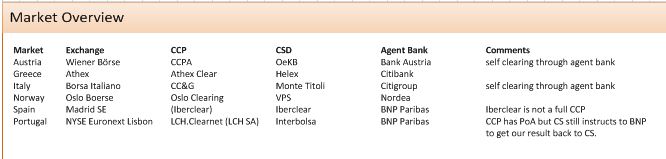

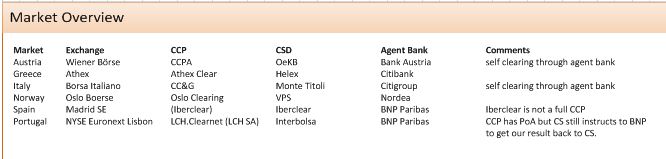

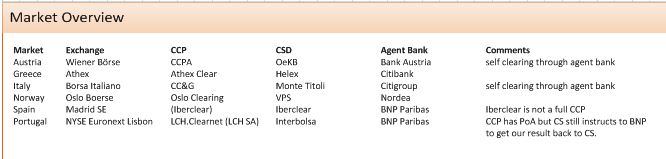

The following picture shows the differences between market, exchange, CCP, CSD and agent banks. Typically we use foreign agent banks to settle the cash on foreign markets.

Central Depository

is a central depositary where we or our agent banks centrally store cash and securities.

The central depositary is typically the place of settlement (PSET) in a Swift message.

See also the picture “Market Overview” above.

Central Securities Depository (CSD)

is a Central Depository for securities

| (SLW) Provides facilities for holding securities in either immobilized or book-entry form. In addition to providing this safekeeping role, a CSD may provide trade comparison services, and clearing and settlement services. |

CID (client identifying data)

is data that is able to identify clients, examples are: Client name, Address, Phone number, email address, Date of birth, CIF or account number, payments or details of payment instructions

Regulation like banking secrecy laws (e. g. Switzerland, Luxembourg Singapore) stipulate that CID cannot leave the country. In the shared components of RTS no CID is used, but only non-identifying references on CID or encrypted data.

In the data delivery layer located in the relevant country, the non-identifying references are resolved and mapped to CID.

Clearing

The clearing process is done by a clearing house. It can be done for pure cash payments and for DVP (cash and securities together)

The process includes

- a netting of trades and

- the information of the counterparties about the trades at the exchange

The clearing of securities typically follows the order matching at an exchange.Very often, a CCP is attached to the clearing house and becomes central counterparty for selected trades.

|

Clearing refers to a series of procedures for guaranteeing settlement finality where KRX, as a CCP, intervenes for the trades executed among members by becoming a buyer to all sellers and a seller to all buyers, finalizing source Korea Clearing house KRX |

Clearing House

is the financial institution that organises the clearing.

Client-Side

Client-side stands for the accounts kept at our bank and the transactions and movements on them.

| (SLW) The order /order leg which results in position movement in client depot |

Client-Side Accounts

stand for the accounts of our clients and of the bank (German Eigenbestand) itself.

Client-Side position management

is the business capability, situated in Operations that aims to keep the client-side accounts up to date.

(BCM 7.10. Cash and Stock Position Management)

Key differences to street-side position management:

- Client-side position management in the custody and private banking area use contractual booking, while the street-side uses the broker dealer model.

- As opposed to street-side position management, positions on the client-side require far more data. Typical example for these additional attributes are valuations and different types of reservations.

Collectively Stored (German: sammelverwahrt)

| (SLW) Storage in a Vault can be “Collectively stored” or “Single stored” (German “sammelverwahrt” und “einzelverwahrt”). The single stored contains at least as additional attribute the safekeeping account number of the client und all information it needs to identify 1:1 the explicit delivered piece. In case of collective storage there is no individual identification, e.g., coins or other assets that do not carry individual identification. In such cases, customer assets are kept in a pool, and any items from the pool can be delivered (pools are typically defined by origin, purity level, weight, etc.) |

Compression

is the settlement of many settlement obligations inside one single movement on the street-side accounts.

It is a special kind of shaping.

| BCM 7.1.10: Trade Compression The enrichment of trade records to enable effective and efficient downstream processing. Trade enrichment includes the calculation (figuration) of cash values, selection of custodian details, determination of transaction reporting method, etc. Enrichment may need to form part of the trade lifecycle management capabilities that are performed after the creation or designation of specific versions of trade records, and that must be carried out independently of trade execution/recording capabilities. |

See also –> netting.

Confirmation

is a type of financial messages that approve the validity and the fulfillment of

between us/our clients and our agent banks and counterparties.

Typically for each of the categories 1, 2 and 3 different systems are used, e.g.

- Contract confirmation systems (in Credit Suisse Fenics)

- Order Management Systems

- A Validate Settlement System

The confirmations may be in paper form (e.g. signed OTC contracts) or electronic form (e.g. SWIFT messages).

see –> settlement confirmation

Contractual Booking

(also custody booking model) Is the booking of client-side account transactions into the client-side position management system after an order got executed as of value date.

Already the arising transaction represents a “contract” for the bank. In contractual booking, the client-side booking happens before the settlement.

Contractual Settlement

Counter

see vault

counterparty

represent either

- contract partner on the other side of a transaction or

- (in operations) the bank that is the account servicer of the account of the other side. Our side is either a book of the bank or the client.

Corporate Action

todo…

Creditor

is one side of a cashflow or a transaction. The quantity of the concerned position augments with a credit.

CUBE

(SBIP) is an order manager for transfers.

Custodian bank

| (RTS)A custodian bank is a specialized financial institution responsible for safeguarding a firm’s or individual’s financial assets and is (normally) not engaged in retail or investment banking. The role of a custodian in such a case would be to hold domestic and foreign assets/securities, arrange settlement, perform corporate actions (incl. handling of tax / tax reclaims), provide information on the securities regarding annual general meeting, etc. Custodian Service requires sophisticated securities Position Keeping services with long term focus, including the knowledge of where the securities are held (deposited), and whether the stock is borrowed or lent or is used as collateral (i.e. capabilities to model reservations, blockings and restrictions). Not the single trade but rather many trades with same custodian (depository) / FI form the position. source Books and Records TIM |

We use custodian banks as our agent banks (aka our “custodian”) for settlement.

Custodian

| (SLW) «Custodian» is the next party in the delivery chain (account servicer / account servicing Institution). In SLW there are quite a lot of differentiation if the custodian is a

In our context we use “custodian” as umbrella term for all of them. Used synonymously for the “Agent” as per SWIFT Settlement chain definition (also same term used in RTS). Agent is the party closest to the Buyer / Seller. |

see Agent/Agent Bank

Custody

is the service a custodian bank provides to clients for safeguarding financial assets.

A bank can also provide custody services, even if it is not focused on it, like a Custodian.

Custody booking model

custodian or private banks use the custody booking model. In particular for client buy or sell orders, this model uses contractual booking.

Transfers, however, are always settled as actual booking.

Custodian Transfer

(for street-side accounts) used for a transfer of our positions from one custodian to another custodian.

(for client-side accounts) When a client is moving assets to or away from our safekeeping.

| (SLW) Transfer of positions from one custodian to another custodian. Typical scenarios of custodian transfer may arise when a client is moving assets from / to CS safekeeping. |

Custody Transaction

| (SLW) Based on a client order to settle / transfer securities.

Different scenarios for this order: |

Customer Order (German: Kundenauftrag)

| (SLW) The order/order leg which results in position movement in client depot |

see –> order

Data delivery layer

(RTS)is the service in the different locations, that maps non-client identifying references to CID, so that users can see the relevant client data.

Dealer

When executing trades for its own account, the institution is said to be acting as a dealer.

see also Broker-Dealer

Debtor

is one side of a cashflow or a transaction. The quantity of the concerned position diminishes with a debit.

Deliver against payment (DvP)

Swift: MT543SLW: GA582

Deliver Free of Payment

Swift: MT542SLW: GA581

Denomination (German: Stückelung)

| (SLW) Nominal amount or Units. Part of Securities master data, identifies the smallest denomination of the security. Information is relevant for physical securities. Also in cases of corporate actions / securities distribution to identify scenario for elimination of fractions, etc. |

Depositary (German: Depotstelle)

is a naming for the physical storage of street-side accounts. Depositaries may exist at agent banks or at a central depositary (CSD).

Depot

(SBIP, German) for securities account

Done Away Trade

| Client has traded outside CS, with other broker dealer, and orders CS (as their custodian) to settle the trade |

DTA File

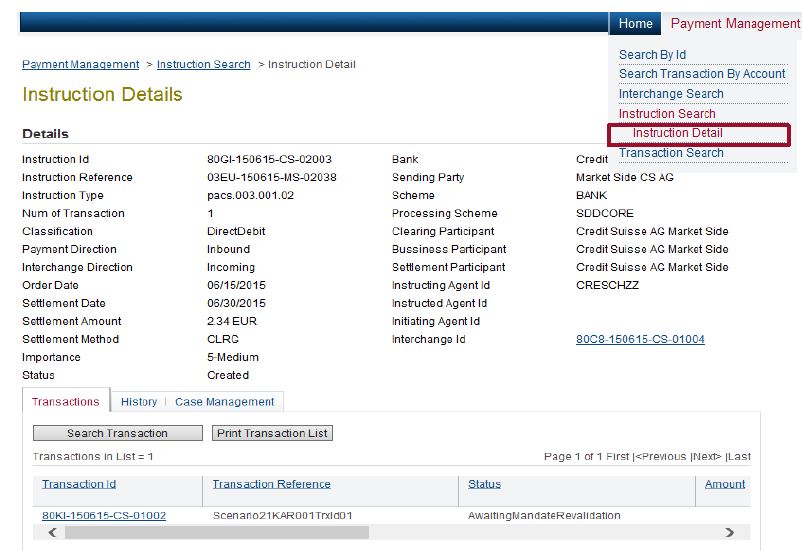

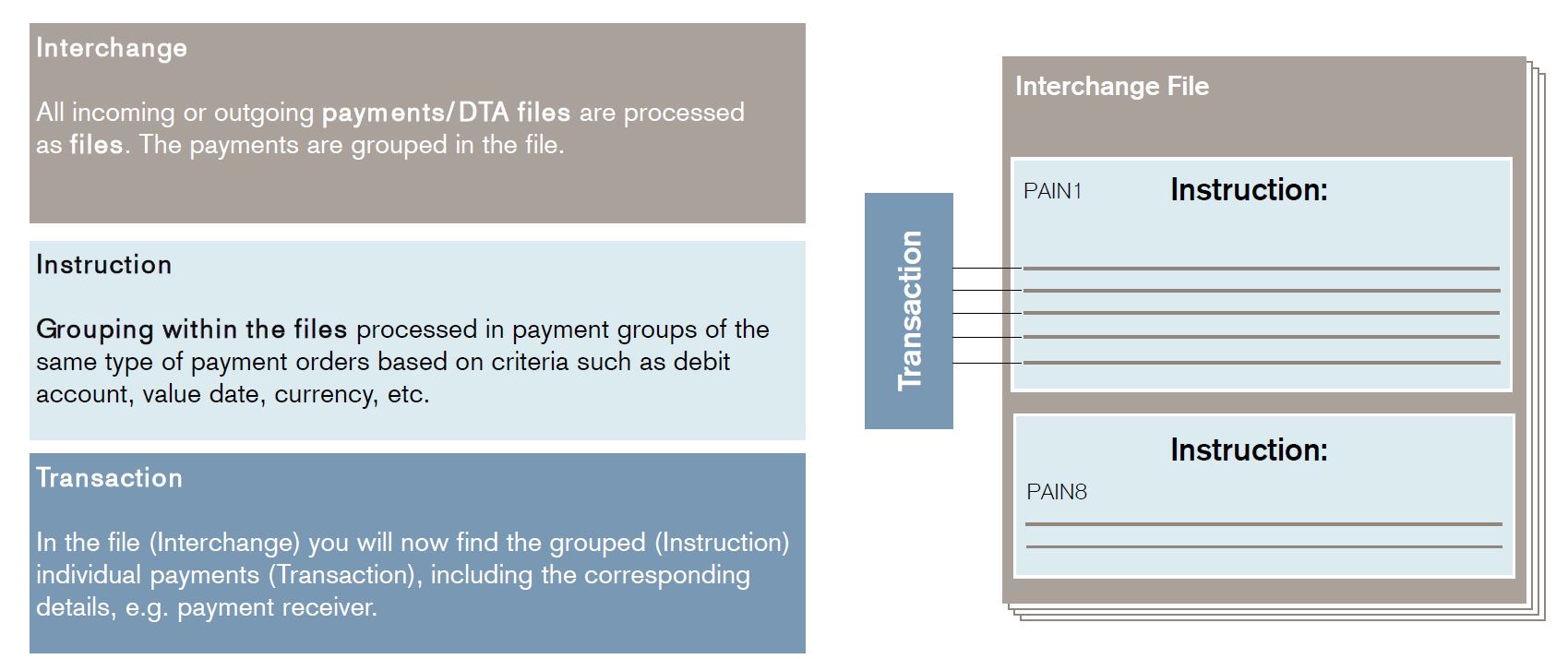

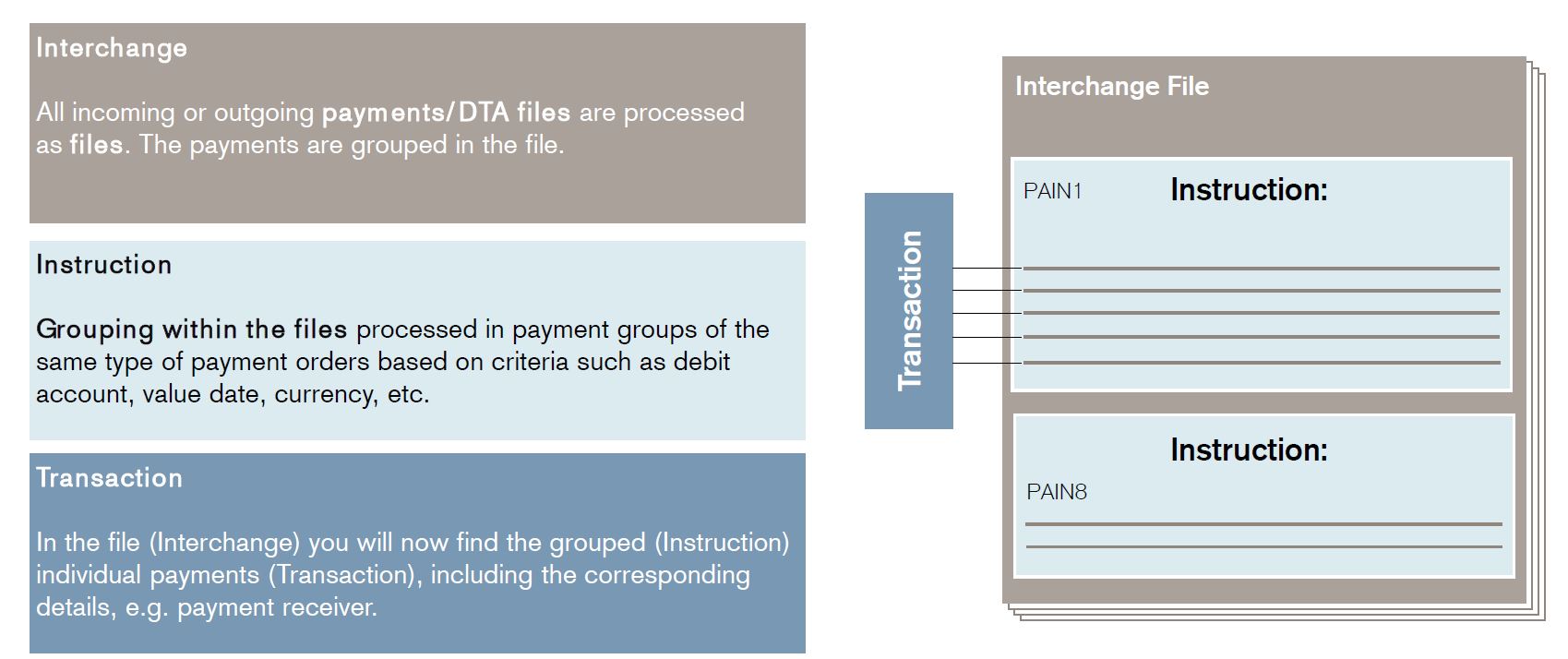

GPP sends and receives interchanges (fulfillments) in a so-called DTA file. The following graph gives an overview of these files and its structure.

Eigenbestand

(SBIP, German)

a proprietary position of a bank, at book or account level.

Enrichment

is the process of completing transaction data for orders and settlement obligations so that settlement data are clear. This includes:

- In trade support (front-office): Specification of stock exchange for securities orders and clearing methods for cash flowsIn operations:

- Definition of standard settlement instructions (SSIs) based on asset class, exchange and clearing method, and other data

- Application of SSIs to settlement obligations to obtain enriched settlement obligations

Exchange

is a financial market where buyers and sellers meet to match their orders.

Execution

see trade.

Expected Booking

Expected booking is the booking that is generated in street-side position management as soon as a new settlement obligation has been received and enriched with SSIs.

| (RTS) By reception of a SO of type delivery, expected booking is performed. The SO was (in delegated model) or will be (by SE) instructed to the market. The expectation is that ultimatly a fulfilment will match with the obligation. But at the time of the reception of the SO, the advise has not arrived yet. source TIM Books and Records |

Expected view

Doing an expected booking provides a database view on the booking process, an “expected booking view” inside street-side Position Management Systems.

Fails determination and notation

The business capability performed by the reproblem agent component (RA).

| BCM 7.4.6: The recognition of the state, and subsequent notation thereof, when an SO fails to settle (either fully or partially) by the appropriate designated time on the expected settlement date. This will vary by market. This notation is used by downstream capabilities to determine fails compensation amounts and direction (debit or credit). |

Fee Leg

(RTS) One of several legs of a settlement obligation. The fee leg is a store of fees-related attributes

see more under leg.

Final State (German: Endstatus)

| (SLW) End of life event for a settlement transaction. This status is set to transaction, either when SLW has completed all the processing, or also through operation intervention

when an in-progress transaction has to be immediately stopped. |

Finance

is the part of the bank that reformulates and synthetises account movements and account positions for reporting, regulatory, tax and bank capital management purposes.

This includes:

- Profit and Loss (P&L) statements on different granularities (e.g. from a product over legal entities to the whole bank)

- Balance sheet statements on these different granularities for these positions.

Finance account

Finance uses the term “account” for various groupings of their profit & loss and balance sheet statements in the subledgers and the general ledger.

Financial messages

are messages among financial institutions that are typically different electronic financial channels like SWIFT, SIC or SEPA. Financial messages follow different common like ISO 20022.

Financial Messages Platform (FMP)

Is a Credit Suisse application for sending and receiving financial messages.

GPP MarketSide connects to FMP.

FIX

Is a protocol used in the post-trade area, e.g. for order allocations and partial executions.

It also settlement functionality but this one is not often used.

Front-Office (FO)

are the functions in a bank directly related to books and clients.

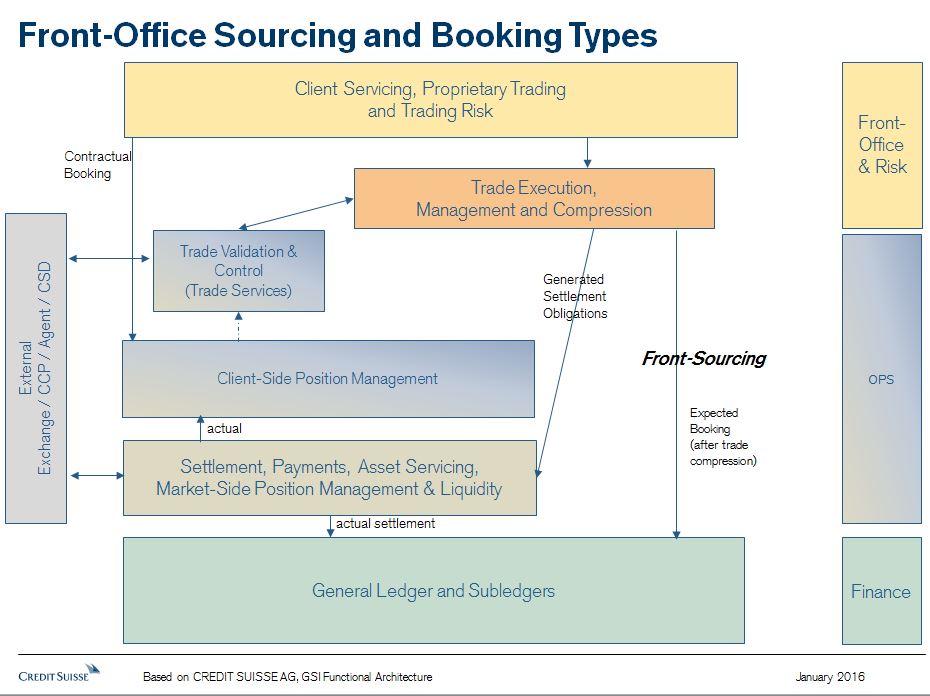

Front Sourcing

According to Front-Sourcing guidelines, P&L flows and balance sheet should flow directly from Front-Office to Finance and should be decoupled from OPS flows.

Front-Sourcing delivers expected booking requests. Executed orders lead to information flows inside the bank:

- a finance flow from the order managers to finance (into the balance sheet items)

- a finance flow from the order managers to finance (into the Profit &Loss items)

- a settlement obligation flow, from the order managers to Operations, that aims to settle the cash flow

- and finally a booking into the client-side position management and street-side position management system(s)

Fulfillments

(RTS) Fulfillments are the objects that are created after a confirmation has been received from from our agent banks.

Fulfillments partially or fully close – they “fulfill” – settlement obligations.

In SLW, an independent object “fulfillment” does not exist. Fulfillment messages are received and attached to an existing settlement transaction.

General Ledger

A storage of finance accounts and their valuation at a less granular level. It’s mainly used to do financial reporting.

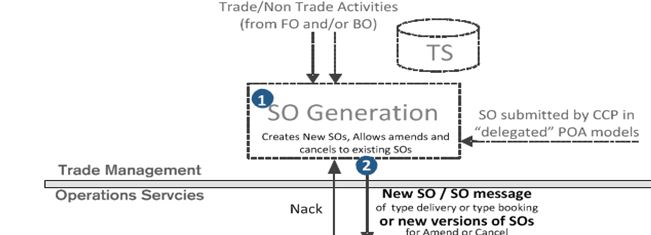

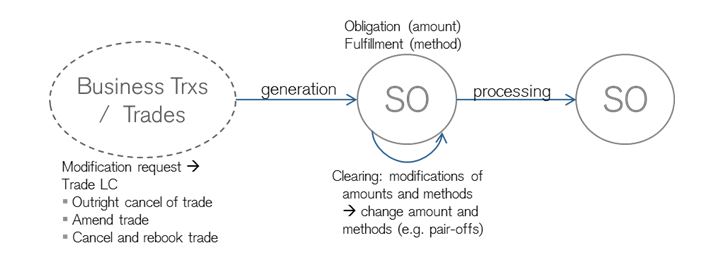

Generation Cycle

is the first part of the RTS lifecycle. The SO generator – typically an order management system – creates, amends, cancels or rebooks transactions that result in (changed) settlement obligations.

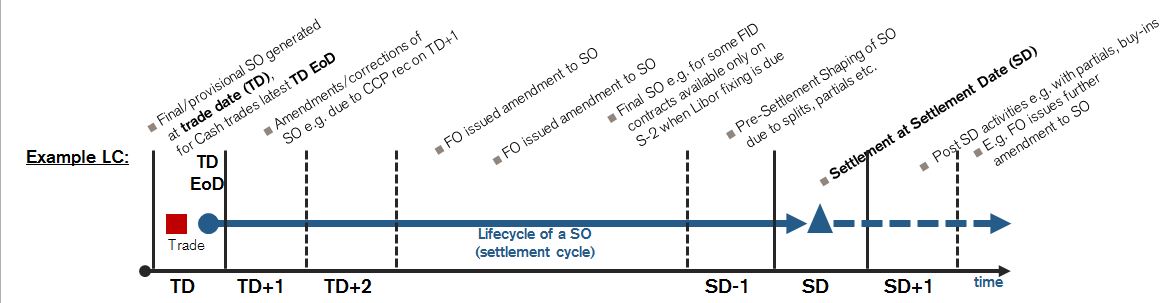

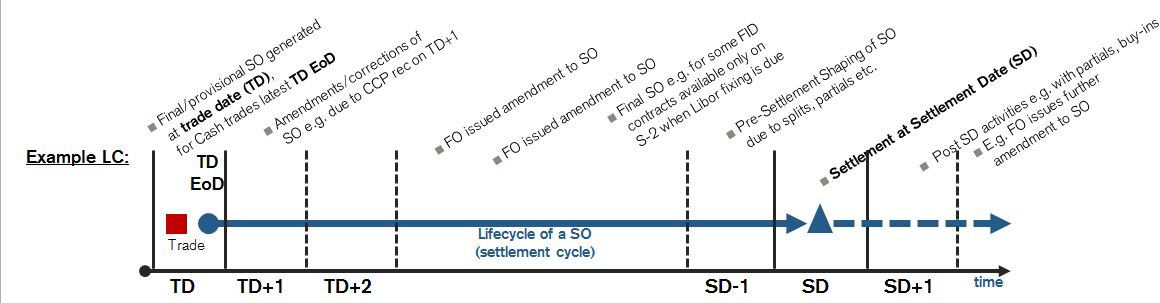

The following graph shows typical events in the generation cycle.

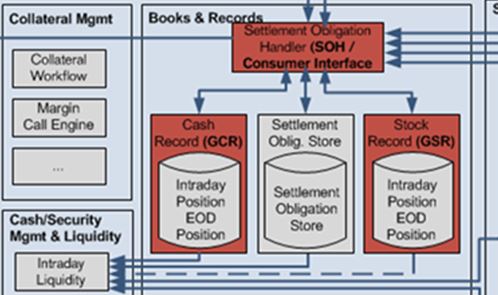

Global Cash and Stock Record

(RTS) is a future Credit Suisse system in Global Operations that is supposed to do street-side position management but it is not a full-fleshed Client-Position Management system.

It uses the broker-dealer model for booking client-side positions.

The following slide from the OPS TIM Books and Records show some of the client position management functionality.

Global Custodian

| (SLW) An agent providing access to multiple markets, typically using a network of sub-custodians in respective markets, in certain cases the global custodian may also have direct participation in the local market (e.g, participation in the local CSD). |

GPP MarketSide

is the part of GPP that is connected to the market via financial messaging.

The principal accounts are

- the different street-side accounts for Credit Suisse, i.e. a Credit Suisse SEPA Nostro Market Account, a Euro-SIC Nostro Market Account.

- a suspense account for repairing problems in messages

- a blocked account for messages that have been raised by sensitive countries and money laundering rules

GPP MarketSide provides a GUI for dealing with the market and for solving problems associated with the above accounts.

(RTS) GPP MarketSide is a problem for a PayMS.

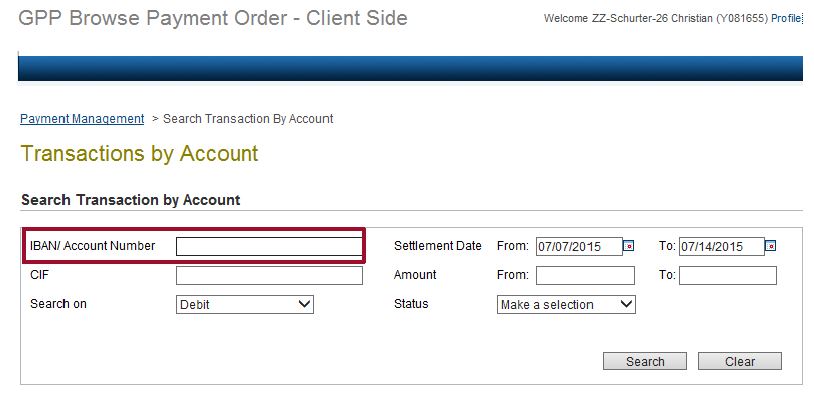

GPP ClientSide

is the part of GPP that receives payment orders from client-facing and Front-Office applications.

Therefore it represents an order management system, more specifically a cash-feeder.

GPP ClientSide has a front-end, called BPO (Browser Payment Order) a browser to view payment orders and their status. Once payment orders are executed (become cashflows), GPP sends booking requests to the Swiss finance and position management systems (NBS and XBS).

It also reflect the movements on different wash accounts.

Immediate Booking

German: Sofort Buchen (SBU)

equivalent of actual booking model, below in the case of transfer. Booking happens immediately for already settled transactions. One example is a transfer.

| (SLW) When the booking in the client depot is effected immediately and is not dependent on the completion of securities settlement in streetside (also referred as Contractual Settlement)

Changes during Settlement which can affect the imediated booking are managed as follows: |

Instruction

is the financial message that tells an agent bank or a counterparty how to settle a (shaped) settlement obligation.

It typically tells the participants which street-side accounts, e.g. accounts at the agent bank, CCP, etc. shall be used for settlement.

As opposed to an advice, an instruction is a message from the owner of a street-side account to the account servicer.

| BCM 7.4.4. Asset Movement Instruction The process by which assets are caused to enter, leave or move between, Credit Suisse’s accounts. A view over all incoming receipts (cash and securities) will assist with determining the timing of any release of payments/deliveries, subject to commitments to CCPs, CLS, etc |

Typical Instructions in SWIFT, for securities:

MT540: Receive Free of Payment

MT541: Receive Against Payment

MT542: Deliver Free of Payment

MT543: Deliver against payment

| (SLW) Instruction is used for the message sent to the custodian (MT540-544 – settlement instruction) – important: e.g. rules/master data/client agreements should not be called instruction to avoid conflicts in understanding) |

In GPP one instruction can refer to multiple payment orders (in GPP also called transaction). In GPP, the term settlement obligation is not used. Instead the instruction is directly linked to one or more payment orders.

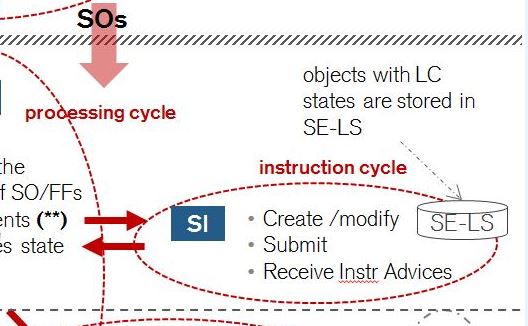

Instruction Cycle

(RTS) The instruction cycle is started with the event “instruct”. During the instruction cycle, the settlement engine creates and submits settlement instructions (SIs)

based on (shaped) settlement obligations. It can also receive advices from our agent banks.

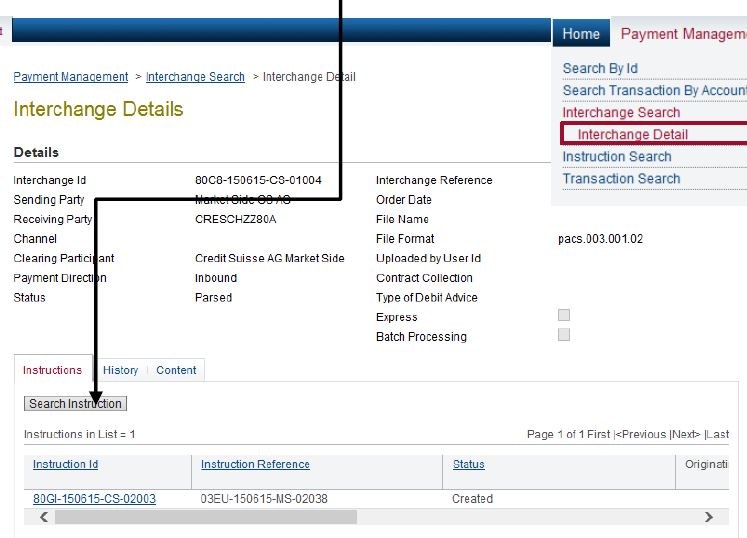

Interchange

(GPP)

terminology for a transmission of instructions. For each interchange one or more instructions can be found.

Intercompany Netting

is the netting of multiple (shaped) settlement obligations between two financial institutions.

Internal booking

| (RTS) An internal booking does not require any activities with the market. It is a booking done for a given legal entity and “simply” require a transfer within the booking system. The SOs of type booking and subtype blank are typical internal booking. Source TIM Books and Records |

Kompensation

| (SLW) German: for compensation. The SLW term for netting of two settlement transactions in SLW. |

Legal Entity

Is a subsidiary of our bank, that establishes its own financial reporting.

As opposed to a business unit, each legal entity often a different network of agent banks.

Leg

(RTS) A settlement obligation can have different legs based on asset type. In order to settlement to whole obligation all legs must be settled.

source Books and Record TIM |

(SLW) see –> order leg

Lifecycle of a settlement obligation

Settlement obligations following a lifecycle according to states, indicated on the arrows.

The following graphs gives an overview of the lifecycle broken into

Linked Settlement

| (SLW) In case settlement of one transaction has dependency on settlement of another transaction. |

Linked Order

(SLW and general)

| (SLW) In case more than one orders are linked together as a result of a common input/event in CS systems. Typical scenario of linked order may be in Corporate Actions related orders, where for the same event multiple orders are created corresponding to each of the eligible positions (distribution of CA results), or in case of re-alignment of position between segregated account and main account (ATF order and normal settlement DVP / RVP order). |

Liquidity management

TIM: Intraday Liquidity

Manage rules for smoothing of outgoing instructions to optimize liquidity availability based on inflows and market liquidity rules and incentives.

see also street-side position management.

Local Custodian

| (SLW) Provides custodian services in local market, and may typically have direct participation in the local CSD. |

Locked-in trade

(RTS) A locked-in trade is a settlement obligation or a settlement obligation, where the settlement process has been initiated by a CCP.

For this locked-in trade we obtained a notification, e.g. an MT548.

Loro account

(from Latin “their”)

In the communication between us and our agent bank, used for the data of the counterparty of our trade.

Market

Market is often used for a country with an exchange, e.g. the German market, the French market, where trades need to be settled.

The term “execution in the market” means finding a counterparty of a trade.

Market Claim

(SLW) MT548/MT544-7 tags: :20C::CORP// & :22F::SETR//CLAIMT566 tags: :20C::CORP// & :22F::ADDB//CLAI

Matching

(here in the sense of settlement matching)

In RTS, matching compares fulfillments to settlement obligations and marks them as matched, see –> Validate Settlement In SLW, confirmations (e.g. MT544-547) are matched against settlement transactions

For matching of orders at the exchange or OTC matching see –> Order matching

Matching Rules

(RTS vs. SLW) see

Merge

Is the form of shaping where multiple SOs are settled by a single shaped settlement obligation, also called the parent SO.

From the client-side view, the settlement obligation gets more “complex” because it now settles many transactions in the market.

From the street-side view, it becomes more simple and cost-efficient, because one street-side movement can settle many client transactions.

Movement

is a change in the quantity of financial assets at a position level, for example in the client-side position management or street-side position management.

The process of booking causes movements.

Netting

allows to combine during pre-trade:

- many orders into one single order (bulk order)

In post-trade (see also PTSOG)

At the CCP:

In the settlement cycle,

- (RTS) netting transforms many (shaped) settlement obligations in one (shaped) settlement obligations.

Netting explicitly allows to combine debtor and creditor sides.

(in SLW) –> also Kompensation

Nostro Account

(from Latin “Our”)

Communication between financial institutions use the word Nostro for our street-side account contracted at an agent bank or a central depository.

In GPP: They are typically grouped by financial message channel like “SEPA market account” or “SIC market account”.

street-side accounts also includes for exception handling like suspense accounts and blocked accounts.

(SLW, also): Custodian Account

Notification

is an information from the market, e.g. from an agent bank or a CCP.

(The following is used in RTS)

| (RTS) is the RTS term for an advice obtained from a CCP or an agent bank that generates a settlement obligation. It leads to a settlement obligation of subtype notification. |

Omnibus Account

see Nostro

Operations

is the part of back-office that concentrates on

- settlement

- position management and liquidity management

- transaction management (all types of transactions excluding trades)

Order

is the confirmed intent of a client or – in the broader sense – of the bank itself to do a transaction. Analogously to transactions there are different types of orders, like trade orders or payment orders (relevant for GPP Client Side)

Some type of orders, in particular trade orders (e.g. buy or sell orders), are often not executed. They need a counterparty, that takes the other side of the trade for the specified price.

Other transactions, like payment or transfer orders, will be nearly always be executed. They are not executed only in rare circumstances, e.g. when they got detected by sanctions screening or money laundering.-

(SLW) –-> P90 Order

Order Cycle

see party chain

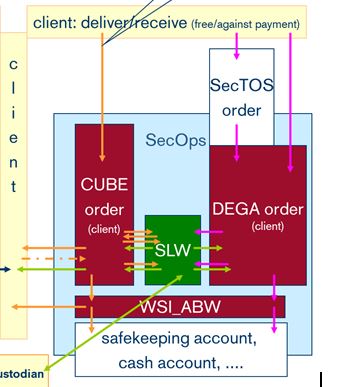

Order Leg

(SLW, SBIP) Orders in the P90 System (P90 Orders) typically have a client-side leg and a street-side leg (German Konform-Auftrag). SLW receives the client-side leg, but mostly ignores its data.

Instead, the client-side leg involves the booking of accounts kept internally (e.g. in DBH). The street-side leg is about the booking of street-side accounts in

the systems SBH (for securities) and XBS (for cash).

Order Management System

(synonyms: Order Manager, Trade Management System) is the application that obtains orders from clients or from other front-office applications. Its main objective are:

- execute the orders in the market. The result are trades or executions of one order.

- inform front-office systems about executions and settlements

- send expected bookings to finance and position management systems

- forward the trades as “generated” “settlement obligations” to a settlement obligation handler

Many order management systems also integrate VnE (Validation of the orders and enrichment with market data).

In the Credit Suisse IB architecture function 4 is assumed by a Post Trade Settlement Obligation Generator (PTSOG).

Order Matching

The process of matching buy orders with sell orders at an exchange or OTC.

OTC (Over the Counter) Contracts

Most transactions follow a base contractual agreement between the bank and the client that formulises how to enter trade or payment orders.

They are based on standardized financial assets usually traded directly between the two parties.

OTC contracts, however are agreements between two counterparties, based on a new contractual agreement. OTC contracts lead to a series of transactions or cashflows.

The task of operations is to obtain confirmations for the contract and and cashflows.

P90 Order

(SLW/SBIP) P90 is the database in the SBIP host for orders.

In WS-Infra and other order managers like CUBE, orders are created for both client-side accounts and street-side accounts as Konform-Auftrag.

Orders for client-side accounts come from the front-office systems. The ones for street-side accounts are initiated in SLW.

Pair-Off

is a form of netting.

| Pair-off are several already instructed SOs are fully or partially offset by SO in opposite direction (same counterparty, same instrument). Full pair-off net settlement amounts cash and stock are zero.source SO Lifecycle Model |

Parent SO

In the shaping process, the parent SO is either

- the settlement obligation before it gets split into n children (n shaped settlement obligations)

- the shaped setlement obligation that arises after a merge of n settlement obligations (children)

Payments Market-Side (PayMS)

Payment related SOs of type Delivery are sent to PayMS; PayMS is a special combination of Settlement Feeder and SE.

Hence

- it enriches an SO with cash flow related SSI and sends this enriched SO back to the SOH (Settlement Feeder functionality).

- it creates the Settlement Instruction (SI) and sends it to the marke (Settlement Engine functionality).

- it handles status advices and allegements from the market (Validate Settlement functionality)

Partial Settlement

(business context and SLW)

Settlement by partial fulfillment of delivery or receive. Scenario of partial settlement arise when settling parties agree to settle a

pending settlement instruction in parts (e.g., due to immediate non-availability of securities / cash, etc.).

| (RTS) Partial Settlement happens when all other matching rules are fulfilled but the quantity in one or both legs (cash and securities) do not match. |

| (SLW) Settlement by partial fulfillment of delivery or receive. Scenario of partial settlement arise when settling parties agree to settle a pending settlement instruction in parts (e.g., due to immediate non-availability of securities / cash, etc.). |

Party Chain and Settlement Cycle

is a path from our accounts or clients’ accounts over our street-side accounts at agent banks to central depositories that permits to uniquely identify the owners of the accounts.

Settlement obligations may be settled over such party chains.

Payment

is a type of financial transaction based on a client payment order that results in a cashflow, an executed payment order.

(RTS) is a combination of settlement engine and validate settlement for cashflows.

Payment Order

Is a type of order for a single cashflow.

In GPP, it is also called transaction.

The transaction ID references the payment order from the front-office systems, while the transaction reference is the internal GPP for the payment order.

Pending (status)

| (SLW) An open settlement transaction (SLW Transaction) that is in progress, normally also instructed in the market, and awaiting settlement. |

Place of Settlement (PSET)

| Entity or organization in the settlement chain where the securities change hand from one party to another party, either physically or in bookkeeping. |

see the Swift attribute –> PSET

Position

represents the holdings of a financial asset. Books and accounts are containers that hold several positions.

Position Keeping

is either client-side position management or street-side position management.

The following table shows the responsible systems for position management and their bookings in the Swiss SBIP:

| Client-Side Position Management | DBH | XBS |

| street-side Position Management | SLW | XBS |

Based on the type of financial institution different requirements arise:

Position Type

can be

the asset class on a position or

Position Type Segregation

is the use of different omnibus accounts at a CSD or a clearing house for different usage types.A typical segregation is between an one account for proprietary trading and another account for client trading.

Often the rules of the clearing house require a different levels of protection against default for these two types of accounts.

(SIX-SIS) concept used in Swiss Market (SIX-SIS) to reflect a sub-account structure within a main account

| A Swiss market – SIX-SIS concept to segregate positions within an account for different purposes.

Typical use of Position Type segregation is: – Tax related segregation, e.g., US Withholding tax related tax pools, UK stamp tax etc. Positon Type concept is used to segregate position into different tax relevant pools |

Position Type Transfer

(SIX-SIS) move from one position type to another inside an account at a custodian, indicating segregation of positions for various factors such as Tax, T2S, Registration etc.

| (SLW) Transfer of position from one position type to another inside an account, indicating segregation of positions for various factors such as Tax, T2S, Registration etc. |

Post Trade Settlement Obligation Generator (PTSOG)

see SO Generator.

Power of Attorney (PoA)

Is the autorisation to create movements on an account. One example could be a wealth manager that has PoA for a client booked at our bank.

Our agent banks have PoA for our street-side accounts.

Pre-matching

todo

Pre-Client Order

(SLW) is a Settlement Transaction based on an incoming SWIFT e.g. for transfers. SLW sends this SLW transaction as “pre-client order” to CUBE so that CUBE creates a client order.

Product

the term “product” can be used in various meanings, like asset classes, or for types of settlement channels (e.g. SEPA, SIC, SWIFT).

Processing Break (German: Abwicklungsstopp)

| (SLW) A break in STP process that requires operations to intervene in the processing of transaction. Manual intervention may relate to correcting details (e.g., data corruption), cancelling a wrong instruction, manually creating a new instruction to replace a wrong instruction, and several other indicators to capture / limit the impact of operational intervention, e.g., only correction in our books (no street side impact), correct the street side through manually created transaction / instructions, etc. |

Processing Cycle

(RTS) The processing cycle starts when settlement obligations are submitted to the Settlement Obligation Handler via the generation cycle.

During the processing cycle two major type of events happen

- Settlement obligations are enriched with data from the Settlement Feeder

- Settlement obligations are shaped in the Settlement Engine

An SO of subtype instruction leaves the processing cycle with the event “instruct”, i.e. when an instruction is issued. It moves into the instruction cycle.

An SO of subtype notification leaves the processing cycle with the event “accept”. It moves into the validation cycle.

PSET

An attribute in a Swift message that designates the place of settlement. It is typically a central depositary (CSD) or a central clearing house.

Receive Against Payment (RVP)

Swift: MT541SLW: GA512

Receive Free of Payment (RFP)

a transfer to be received in our bank.

Swift: MT540

SLW: GA511

Reconciliation

in the area of settlement, the major reconciliation is between the positions of street-side accounts.

This means that

- The “original” kept at the account service (agent bank or CSD) and the pending movements.

- The “mirror” in our street-side management systems and its pending movements.

Reg. Shares (German: Namenaktien)

| (SLW) Securities static data related – securities held in registered form. |

Registered Party (German: Aktionär)

| (SLW) The shareholder which is registered at the registrar and is allowed to join the general assembly |

Registrar (German: AR Aktienregister)

| (SLW) Entity responsible for the registration of securities, maintains the shareholder register and provides services to register, de-register, and update shareholder details. |

Registration

| (SLW) Process of registering securities with the Registrar. |

Registration Identification Number

| (SLW) Identifies the owner of the registered position, can be considered like an account (or identification) in books of the registrar. Since the registered share model relies on deferred/relinquished printing (German: “aufgeschobener/aufgehobener Titeldruck”) . It is assigned to the share register. It is a 16 character code, made up of Shareholder number, Depository, Bank reference, Domicile, Nationality, Registration type). The bank has to use this number for all follow-up transaction. The share register has to be informed about all securities movements. |

Release to market

is the issuance of instructions to the market via financial messages.

In (RTS) the event “Instruct” happens and the settlement obligation of type instruction moves to status INSTRUCTED.

Reminder

| (SLW) Operations initiated process to follow-up / remind counterparty, typicall sent as letter or Swift. |

Remote Member

| (SLW) Financial Institutions (e.g., foreign institutions) with direct access to the market (to trade) but do not have clearing access, but they depend on a local participant to facilitate clearing and settlement. |

Registered positions

| (SLW) Registered positions: SIX-SIS maintains different position types like

|

Repurchase Agreement (Repo)

An agreement between two counterparties to exchange cash against securities. The cashflow receiver must pay an interest for the cash.

Typical Settlement (source CSD):

T+1 a transfer of securities happens

T+2 an exchange of cashflows

Interest calculation:

T+2: Typical value date for interest calculation.

Reservation

see –> blocking

Reproblem Agent (RA)

Is a component of the RTS architecture, that should solve failed settlements. It is closely attached to the Validate Settlement component. It implements the BCM function Fails determination and notation.

Rubrik

(German) The code for a street-side account.

| (SLW) Four character code, represents segregated accounts at Custodian |

Safe Keeping

a synonym for either street-side position management or client-side position management

The term safe keeping is used with a focus on securities.

Sanction Screening

based on checklists of sanction countries and sanctioned persons, the sanction screening leads to the identification of susceptible transactions.

Similar to money laundering, susceptible transactions are booked on blocked accounts. While money laundering screening is done on client transactions, both client-side and street-side accounts are examined for sanction screening.

SBH (Sachbuchhaltung)

(SLW) is the table in SLW in the P28 database that contains information about our street-side accounts and their movements.

SECOM

| (SLW) Settlement system at SIX SIS (Sega Intersettle) |

SECOM Message

| (SLW) Communication message used/supported by SECOM. It is based on Swift message but is customied as per requirements of SIS |

Securities Account

an account that only contains positions of asset type securities.

(SBIP, German) Depot

Securities Booking

is the booking of positions in securities accounts. These accounts can be client-side accounts or street-side accounts or wash accounts.

In the SBIP, the securities position of client-side accounts are booked in DBH, the ones of street-side accounts in SBH, the ones of wash accounts in ABH.

The Global Cash and Stock Record is designed to book all three types of positions.

Securities Leg

(RTS) One of several legs of a settlement obligation. The securities leg is a store of securities-related attributes

see more under leg.

Segregated Account

| (SLW) Accounts created to separate positions either for a client or to segregate some specific type of positions (e.g., proprietary positions from client assets). |

Sensal (German for Broker)

(SLW) Synonym for broker as counterparty of a trade.

| (SLW) Counter-party for a trade |

Settleable Transaction Identification

| BCM 7.4.1. The identification and designation of Settlement Obligations (SOs) that require an external movement over a nostro or depot. These SOs could- Originate from internal Credit Suisse systems or from external service providers- Be generated from gross or net transactions, including those that are- Inter-company- Bilaterally settleable- Delegated netting (POA)- Delegated settlement (POA)- Delegated margin (POA) |

Settlement

Settlement is the generation and storage of correct and cost-effective movements of street-side accounts so that all settlement obligations are fufilled.

(BCM 7.4. Clearing, Settlement & Custody)

The generation of movements of street-side accounts involves different tasks:

- Settleable Transaction Identification (BCM 7.4.1): Which settlement obligation exists based on the transactions?

- Settlement obligation shaping (BCM 7.4.2): Bringing together or splitting apart of settlement obligations in order to increase cost efficiency. See –> Shaping

- Shape verification (BCM 7.4.3): Verification of shapes.

- Asset movement instruction (BCM 7.4.4): The generation of “expected” movements of assets on our street-side accounts based on instructions.

- Validate settlement (BCM 7.4.5): The synchronisation between our internal records of movements and with the effective ones on the accounts located at our agent banks.

- Fails determination and notation (BCM 7.4.6): Finding out why accounts at our agent banks did not move as we expected and solving the issues.

The storage of movements is called booking.

Settlement Allegement

(MT578)

is a message from an agent bank, that it cannot match the instructions of the owner of the street-side accounts to the instructions of the counterparty.

In SLW, an allegement is sent to business for reproblem. In RTS, it should be resolved by the Reproblem Agent component.

Settlement Chain

synonym for party chain

Settlement Confirmation

is the financial message that confirms a previous instruction or advice.

Typical examples in Swift:

MT544: Confirmation of Receive Free of Payment

MT545: Confirmation of Receive Against Payment

MT546: Confirmation of Deliver Free of Payment

MT547: Confirmation of Deliver Against Payment

Settlement Date

Can be the

- “contractual”, “intented” or “expected” settlement date when a transaction or cashflow should be settled or

- the actual date when a transaction or cashflow was settled

Settlement Engine (SE)

(RTS) The Settlement Engine (SE) has three subsequent tasks.

|

SLW has the core functionality of creating settlement instructions based on its main object settlement transactions.

GPP Market Side contains the functionalities of a settlement engine.

Settlement Feeder

(RTS)

The settlement feeder enriches SOs of subtype instruction by Standard Settlement Instructions (SSI) obtained by a reference data system for SSIs.

TIM: The Settlement Feeder is responsible for applying SSI’s to the Settlement Obligation in an STP processing scenario as well as routing the settling Settlement Obligations (delivery obligations) to the appropriate Settlement Engine.

TIM Books and Records:

|

SLW is responsible for populating and enriching settlement orders.

Settlement Instruction (SI)

see instruction

Settlement Obligation (SO)

(RTS) is one obligation to settle one or more transactions in the market so that the contractual obligations are fulfilled.

In the SBIP, client-side booking in DBH and XBS is seperated from street-side settlement in SLW and XBS.

Consequently an SO corresponds to two different objects:

- A P90 Order that is booked into DBH and XBS (copied into SLW, as so-called settlement order)

- A Settlement Transaction in SLW that is created based on the P90 Order

In GPP, the term “settlement oblicatiois generated for each payment order.

In GPP, users create n instructions for m payment orders. This n:m relationship corresponds to a “shaped” settlement obligation.

Settlement Obligation Handler

see SOH

Settlement Obligation Store

see SOS

is the component of the RTS architecture that stores the history of (shaped) SOs and SO versions.

Settlement Order

(SLW) In the SLW functional decomposition, the term settlement order is the P90 Order that has arrived in SLW.

In RTS terms, a settlement order corresponds to a generated settlement obligation.

In further processing, SLW works on the object “settlement transaction“ that is derived from the settlement order.

Settlement Transaction

a Settlement Transaction or SLW Transaction is the main object in SLW. It is stored in the SBH database of SLW.

It is derived from the Settlement Order in WS-Infra.

It is mostly a movement on a street-side account, an object that finally represents the booking on street-side accounts.

But it has also the type “k” for client orders

SLW sources SLW Transactions to order managers (like CUBE, DEGA, TU, etc.) to use the data stored in SLW Transaction (P27) database to be used for enrichment of the order being created in Order manager.

Settlement Transaction Type A (German: Abrechnungsreferenz)

| (SLW) Settlement transaction – booked in DBH, settled or not settled A settlement transaction that is booked to safe custody account (typically contractual booking). It may or may not have a corresponding street side leg. |

Settlement Transaction Type B (German: Belegreferenz)

| (SLW) Settlement transacton – Settled but not booked in DBH A settlement transaction of type B represents a settlement transaction (in our books) that has settled in the market, but not yet booked in our books. |

Settlement Transaction Type C (German: CounterParty Referenz)

| (SLW) Settlement Allegement transaction |

Settlement Transaction Type I (German: Instruktionsreferenz)

| (SLW) Settlement transaction – not booked in DBH and not yet settled A settlement transaction of type I represents an on-going settlement in the market, not yet booked to safe custody account. |

Settlement Transaction Type k (German: Kundenreferenz)

| (SLW) Customer/Client Settlement order A settlement transaction of type k actually represents a client instruction that has been received (incoming MT 540-3 from client) and being processed by the corresponding order managers (e.g., CUBE) |

Shaped settlement obligation (Shaped SO)

after shaping several settlement obligations become shaped settlement obligation.

Shaping

Shaping of SOs can occur either pre settlement (for more efficient instructions) or post settlement (to support matching).

Shaping can either be a merge of multiple SOs (a netting) or a split into multiple SOs.

| BCM 7.4.2. The process whereby a series of settlement obligations are brought together (bulk and/or net), or split apart, into settlement shapes to increase efficiency, reduce cost, improve control and mitigate risk (settlement, credit, counterparty, etc). |

| (SLW) Any netting, aggregation, or spliting of settlement obligations received from upstream to formulate a different set of instructions to custodian (not one-to-one mapped to original set of settlement obligations).

SLW has very limited functionality for shaping: Most settlement orders |

Shared Components

are the components of the RTS architecture that are not location-specific. They can be deployed in any location. The settlement engine is one of the few components that are location-specific. Others like SOH, SOS, GSR/GCR, SF and the GUI are shared components.

Single Stored (German: einzelverwahrt)

| (SLW) Storage in Vault can be “Collectively stored” or “Single stored” (German “sammelverwahrt” und “einzelverwahrt”). The single stored contains at least as additional attribute the safekeeping account number of the client und all information it needs to identify 1:1 the explicit delivered piece. Example of “Single Stored” may be for precious metal – bars that carry individual certificate / identification number. In these cases the specific physical asset delviered by client is kept identified. |

SLW

acts as first source of data capture, parses incoming messages and stores the data in its database. Other order managers do not directly use the incoming SWIFT, rather depend on SLW to get already parsed data and use in their respective processing

SLW Movement (SLW Bewegung)

| (SLW) Process of matching confirmation reported by custodian, and marking underlying settlement transaction “Settled”. |

SLW Status

is a shortcode for a function of SLW. Many status leads to a delivery of information to a consumer system. The delivery of the information leads to an event in the interaction.

SLW Transaction

SLW Transaction Type

(SLW) There are four types of settlement transactions, that reflect the lifecycle inside SLW and the position management system DBH.

Type A: –> Abrechnungsreferenz (booked)

Type B: –> Belegreferenz (settled, but not booked)

Type C: –> CounterParty Referenz (settlement allegment)

Type K –> Kundenreferenz (based on Client Order from Order Managers and an instruction)

Type I: –> Instruktionsreferenz (not booked, not settled)

SO of Type Booking: SO(B)

if the accounts involved are internal to our bank, then the SO is a SO of type booking.

SOs of type Booking do not involve external settlement, so are immediately actioned on the expected settlement date.

SO of Type Delivery: SO(D)

if at least one of the accounts involved is serviced externally or the accounts belong to different legal entities, it is deemed an settlement of type Delivery.

SO of Subtype instruction

is the RTS terminology for a (shaped) settlement obligation that requires an instruction to the market.

SO of Subtype Notification

is the RTS term for a settlement obligation that is obtained from the market, e.g. from a CCP.

It is usually already fully dressed – as opposed to SOs of subtype instruction, hence it does not require SSIs.

SO Generator

(RTS)is a component, situated in trade management (more specially in the post trade area), Settlement Obligations have three sources.

|

see also –> settleable transaction identification

SOH Processor

see SOH

SOH (Settlement Obligation Handler)

(RTS) is the central RTS component that routes settlement obligation to the different functions like settlement or booking.Based on the interactions with the other components, it also modifies the status of the SOs, the lifecycle. Its major tasks are:

Source: TIM Books and Records |

SLW is responsible for the lifecycle of settlement transactions.

SOS (Settlement Obligation Store)

is the component of the RTS architecture that stores the history of (shaped) SOs and SO versions.

Split

A split is a form of shaping where one settlement obligations (SO), the parent SO, is divided into multiple SOs.

Standard Settlement Instructions (SSI)

are default values for enrichments of settlement obligations. SSI contain information how to settle them (et. al. which street-side accounts to use) based on different input parameters like product (cash or securities), markets, currencies and trading places.

Status intimation

In SLW and SWIFT, the matching to a transaction, is also called the identification of a status intimation.

In RTS terms, it corresponds a fulfillment, the status update of a settlement obligation via SWIFT – usually transmitted in an advice.

Status Instructed

A settlement obligation in (RTS) moves to status INSTRUCTED, when settlement instructions have been released to the market.

Status Settled

(RTS) A (shaped) settlement obligation

- of subtype “instruction” moves into status “settled”, when its settlement instruction has been fully matched in the validation cycle.

- of subtype “notication” moves into status “settled”, when its advice has been fully matched in the validation cycle.

Stock Leg

(RTS)see leg.

Stock Record

TIM: This is the posting engine for client, firm and mirror (Nostro) safekeeping accounts (depot).

Street-Side

Stands for our network of agent bank and (central) counterparties.

synomym: Market-Side

Street-side Account

is either an account that

- that are owned by our bank, but contracted and located at our agent banks and (central) depositaries

–> Nostro account - that is owned by the counterparty during the settlement of transactions with it

–> Vostro Account - A third party account

–> Loro Account

In RTS: street-side accounts also refer to the copy of these external accounts kept in the Global Cash and Stock record.

Street-side Position Management

the control of street-side accounts in a position management system. Street-side accounts are contractually booked at our agent banks. Therefore management of street-side positions is a “mirror bookkeeping”.

In BCM terms, it is also called Liquidity Management.

(synonym: Market-Side Position Management)

see also –> client-side position management.

Street-Side Order (SLW, German: Konform-Auftrag)

Any order for clients or for our books leads to a settlement obligation.

In order to fulfill the obligation, the bank needs to issue a street-side order that buys the securities for the client at an exchange.

| (SLW) The order/order leg which results in a position movement at the custodian |

A P90 order for street-side accounts.

Sub-account

Agent banks and CCPs organize accounts in main account and sub-accounts for different types of asset classes and settlement purposes.

Subcustodian

is the term for an agent bank or custodian used when we do the custody for clients (e.g. Global Custodian)

Subledger

A storage of finance accounts, their valuation and profit and loss at a granular level. For different types of financial assets there are often different subledgers (this is not necessarily like that).

Examples in Credit Suisse: Savas for securities, XBS for Cash and Murex for OTC.

see also General Ledger.

Suspense accounts

are special types of street-side or client-side accounts that are used to repair wrong or incomplete financial messages.

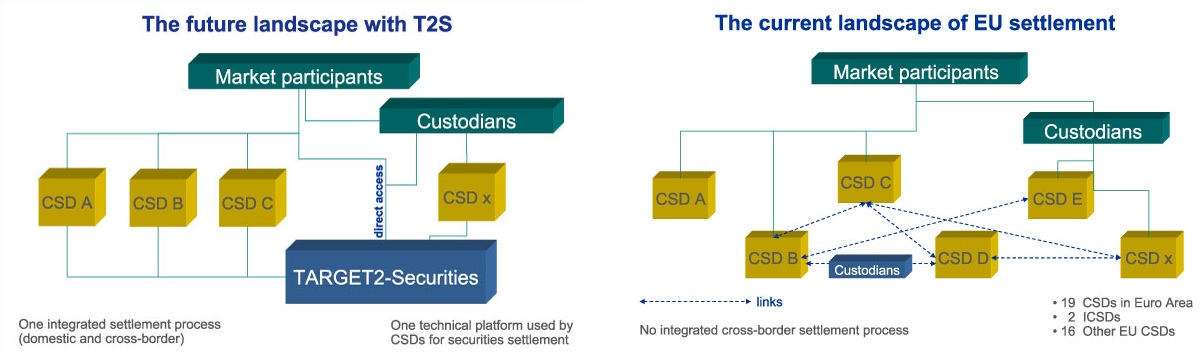

T2S

is a pan-European system for securities that creates a “central CSD” for all other CSDs. While Target2 is focused on payment, T2S is the new central system for securities settlement.

(source ECB)

Target2

is the real-time gross settlement system for payments owned and operated by the Eurosystem,

TLC Code (German: Titellieferungscode, English: Securities Delivery Code)

| (SLW) It is a seven(7) character code, which defines direction of securities and cash movement, custodian area, and some specialities for Settlement such as Cross Border, Inhouse, etc |

Trades

are orders that have found a counterparty, a trade partner, that is ready to assume the other part of the arising contractual obligation.

When an order is only partially executed, we speak of partial executions. Trades are a special type of transactions.

Trade Confirmation

| BCM 7.2.1: The agreement of trade details with the counterparty or appropriate CCP. Trade confirmation can follow different methods, including trade confirmation matching, and trade confirmation affirmation. Segregation of duties is required such that this capability is exercised independently of trade execution/recording capabilities. Trade confirmation can include the generation and issuance of trade confirmations to the counterparty, the receipt of incoming trade confirmations from the counterparty, incoming allegements from a CCP, trade matching, and trade affirmation. As well as being applied to individual trades, trade confirmation may also be applied periodically to portfolios of open trades. This includes bilateral reconciliations, and reconciliations with trade repositories such as CCPs and exchanges. |

see also –> confirmation as general term

Trade Date

is the date when a client or a trader started the contractual obligations of a transaction.

Two examples:

- the date when a trade was entered in a trading system

- (use in broader sense) the date when a client gave a payment order.

Trade Enrichment

BCM 7.1.5: The enrichment of trade records to enable effective and efficient downstream processing. Trade enrichment includes the calculation (figuration) of cash values, selection of custodian details, determination of transaction reporting method, etc.

Enrichment may need to form part of the trade lifecycle management capabilities that are performed after the creation or designation of specific versions of trade records, and that must be carried out independently of trade execution/recording capabilities.

Trade Validation

| BCM: 7.1.4 The validation of data within an enriched trade to ensure effective and efficient downstream processing. This validation may form part of the trade lifecycle management capabilities that are performed after the creation or designation of specific versions of trade records, and that must be carried out independently of trade execution/recording capabilities. |

Transfer

(as transaction or transfer order) a delivery or receipt of securities on a securities account.(in settlement) a movement of securities from one securities account to another – at the same bank or between banks.(as payment) a cash flow or a transfer between street-side accounts.

| (SLW) Transfer of position from one account to another involving same custodian or different. Different scenarios of transfer: – Custody client does a trade outside, and requests CS as their custodian to settlement. From CS perspective this is a pure delivery / receipt not linked to any trade (and hence considered as a transfer) – Custody client (private or institutional) instructs Credit Suisse to move assets out of safekeeping (Delivery Out), or receive assets from another bank / custodian (Delivery In) |

Transformation

(SLW)MT548/MT544-7 tags: :22F::STCO//TRAN

more to write

Transition Account

(SLW) German: Abwicklungskonto is the SLW name for a wash account.

Transaction

is an executed order that require settlement. After booking, they are visible as movements on accounts. We know the following types of transactions:

- Trades after orders for securities

- Transfers

- corporate actions

- Payments in the area of payments and OTC

- Fee transactions

- Borrowing and Loans transaction

- Tax transactions

Similar as settlement obligations, transactions are double-sided with a debtor and creditor part, while bookings are single-sided.

In the new GPP BPO the term transaction (transaction ID,transaction reference) is used as equivalent of payment order.

Transaction Control

| BCM 7.1.13: Is dedicated support to a niche business flow and acts as coordinator for all Operationally aligned functions. Client static data, confirmations, instructions, pre-matching and fails management. Completion of control functions & reporting. Intercompany & interbook reconciliation, FOBO recs, Structured Trade Reviews and Trade Booking Reviews for exotic trades where external validation may not be timely. Also includes checks on the completeness of the trade population. |

Unadvised

Is a cash flow on street-side accounts that is received without a corresponding settlement obligation and advice from a CCP or our agent banks.

Underlying Counterparty

is the counterparty for a trade, as it has been recorded at the matching at the exchange.

Central counterparties (CCPs) typically replace this counterparty by themselves.

Validate Settlement (VS)

is the component that “validates settlements”. Its main function is to match settlement obligations against external settlement events (i.e. advices and confirmations)

It creates fulfillments for matched settlement obligations.

| TIM Definition: The Validate Settlement process is a framework designed to capture and record all available internal and external events to ensure the completeness and accuracy of our books and records as well as to significantly reduce the quantity of discrepancies between internal and external events via the reconciliation process. |

| BCM 7.4.5. A control over the receipt and management of real-time advices and status messages confirming an asset’s settlement state. The control will be performed by matching known internal business events with external settlement statuses on an intraday basis. |

Detailed Definition:

- Validate Settlement (VS) matches external settlement events with SOs in the SOS representing CS internal expected view.

- Where a match occurs, VS links the FF to the matching SO or group of SOs. The FF represents the settled part of a SO (actual view). There can be 0 to several FFs to one SO (reflecting possible fails and partial settlements). VS sends the FFs to SOH for ‘actual’ booking in CR/SR.

- External events without a matching SO (‘unadvised’) are known as not recognised FFs trigger a call to the Reproblem Agent (RA) .

SLW is responsible for managing status initimation and confirmation messages.

Valor

| (SLW) The Valor is the Financial Instrument identification in the SLW environment. – see related asset classes. Sometimes we need the expression “securitized instruments” which mean all assets (shares, bonds, precious metal coins, last wills, insurance policies, borrowers’ notes, etc) which are make visible in the safekeeping account. Remark: processing of options is handled outside SLW |

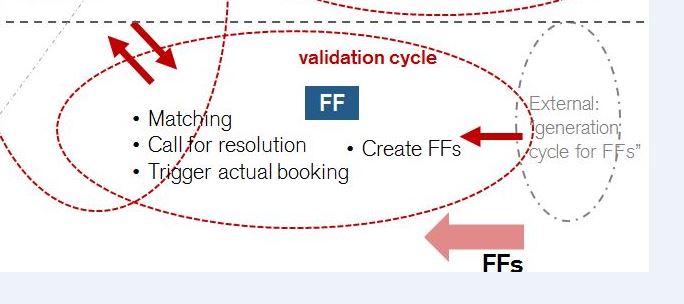

Validation Cycle

(RTS) In the validation cycle so-called “fulfillments“ are created based on confirmations from our agent banks.

These fulfillments are then matched against our settlement instructions.

If they do not match, the reproblem agent component is called for reproblem.

If they match, they leave the validation cycle and go into status settled.

The following image visualizes the validation cycle:

Valuation

is the assignment of prices to positions. Valuation is needed in finance and in front-office, but not in operations.

Some back-office functions outside of operations, e.g. client tax reporting also need valuations

Value Date

is the date in the contractual booking view of a transaction. It is the date that is used for interest calculation, typically for cash accounts.

Vault

is a physical storage of assets, as opposed to the logical storages, called account or depositary.

VnE

VnE stands for Validation and Enrichment. Its tasks are three-fold:

- Validation of orders and trades –> Order Validation, BCM 7.1.4.

- Enrichment of orders with counterparty data or where to settle a trade exactly –> Trade Enrichment, BCM 7.1.5

- Exception handling of uncomplete orders or trades.

VnE are often integrated in the Order Management System.

Vostro account

(from Latin “your”) designates the account of the partner in the communication between financial institutions, for example in the communication between a bank and its agent bank.

Wash account

is an intermediary account for settlement purposes. During the settlement process, they are used to transfer financial assets from client-side accounts to street-side accounts and vice versa.

After successful settlements, wash accounts have always a zero balance. In Credit Suisse, wash accounts exist at business unit level and product level.

XBS

(SBIP) is the Swiss position management system for cash flows.

It contains all 3 types of positions for cash: Client-Side accounts, street-side accounts and wash accounts.

Booking requests for XBS are generated when transactions are created (–> contractual booking) and not when settlement obligations are fulfilled (–> actual booking in RTS) .

XBS is a Client-Side Position Management system, in the sense that it contains all the client-relevant attributes like reservations and valuations.

#Clearing House

See more for